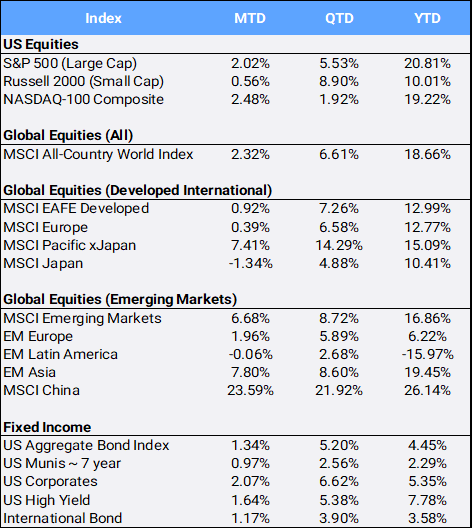

Expectations for global stocks were low for September, historically a challenging month for equity markets. Yet the MSCI All Country World Index’s (ACWI) made five new all-time highs as it gained 2.32% MTD return to bring a choppy Q3 performance to a strong 6.61% return. The global benchmark is up 18.66% YTD in 2024 and has made 45 new trading highs this year. Stocks rallied on good news from the US Federal Reserve, massive stimulus from China, and strong US economic data. Still, as markets climbed, ripples from the feared “yen carry trade” in August and anxiety as we head into US elections are evident as the CBOE S&P Volatility Index (VIX), often referred to as “the fear index” ended Q3 at 16.73 –compared to last month’s 15.00, last quarter’s 12.24, and the 12.45 where we started this year. The second U.S. presidential debate, this time between Vice President Kamala Harris and Republican nominee Donald Trump produced no clear victor on September 10th, but the consensus was that Harris won the debate. Investors are bidding up portfolio insurance protection as we embrace uncertainty facing a very closely projected November US presidential vote.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of September 30, 2024

The US Federal Reserve made a larger-than-usual 0.50% interest rate cut when it met on September 18th. Chairman Jerome Powell called the rate reduction a “recalibration” of central bank policy. It was its first interest rate cut since the early days of the Covid pandemic, and a post-meeting statement noted, “The Committee has gained greater confidence that inflation is moving sustainably towards 2% and judges that the risks to achieving its employment and inflation goals are in balance.” The Fed’s preferred inflation indicator, the personal consumption expenditures price index came in at 2.2% annually, down from 2.5% in July, and its lowest reading since February 2021. Later in the month, Powell noted while more interest rate decreases could be forthcoming, he cautioned that the central bank does not have a preset path.

Still, US Treasury yields eased across the curve, and its long-inversion has finally normalized as the 2- and 10-year rates closed Q3 at 3.64% and 3.78% after starting the year at 4.25% and 3.88% respectively. As yields and prices have an inverted relationship, the US Aggregate bond index gained 1.34% MTD, 5.20% QTD and is up 4.45% YTD.

Internationally in developed markets, harmonized inflation rates in France, Germany, and Spain have plunged below the European Central Bank’s 2% inflation target in September. These figures are likely to boost the chances of another interest rate cut from the ECB. The Reserve Bank of Australia kept interest rates steady and indicated that rate cuts are not on the near-term horizon as inflation remained above target. In Japan, the yen jumped 1.80% MTD while it stocks sold off 1.34% in September after former defense minister Shigeru Ishiba won a run-off election to become the country’s next prime minister. Ishiba has endorsed the Bank of Japan’s stance of moving away from decades of yen-weakening and ultra-loose monetary policy.

In Emerging markets, the big news this month was China’s central bank and communist party in parallel unveiled the biggest stimulus package since the pandemic to fight deflation and move back its economy back towards its 5% GDP target. Chinese stocks surged nearly 20% in a single week, marking its best weekly gains since 2008, and were up 23.59% in the month to bring YTD returns to 26.14% as the People’s Bank of China announced the use of its own capital to directly prop up stock and property markets – a move not seen in recent history.

On the sector front, Q3 returns were led by Utilities, gaining 19.37% QTD to bring their YTD returns to a best-sector gain of 30.63%. All but one sector posted positive Q3 gains, with energy being the detractor declining 2.93% in Q3. Its 7.40% YTD return also marks the worst overall sector performance so far in 2023. Crude oil prices posted its third monthly loss in a row in September, falling 7.31% MTD and are down 16.40% QTD and 4.86% YTD. Oil prices remain under pressure in part because OPEC+ plans to begin increasing production in December. Meanwhile, Gold gained 5.24% and hit an all-time high of $2,685.42/oz in September as it is experiencing a historic rally driven by global monetary easing and heightened Middle East tensions. Gold gained 13.23% QTD for its best quarter since 2020, and the famed “safe haven” asset is now up 27.71% YTD.

Bitcoin finished its strongest September since 2012 with an 8.03% gain and its second positive September in a row – where historically, it is the cryptocurrency’s weakest month. The asset known as “digital gold” gained 6.10% QTD and is up 52.10% YTD.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of September 30, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures or visit our website at perigonwealth.com.”