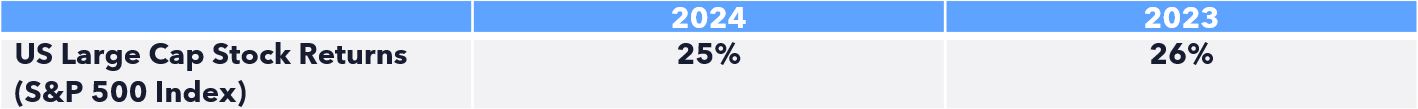

As we close the book on 2024 and ring in 2025, one thing is for certain – 2024 was a fabulous year for US stocks, following a similarly strong year in 2023. As I read different market opinions for expectations for 2025, I am a little unnerved by the rosy picture being painted by most of them, pointing to the resilience of the U.S. economy and the strong outlook for U.S. corporate earnings profitability. By most accounts, there are very few clouds on the horizon. I don’t dismiss any of these positive indicators, but I also think as humans we have a tendency towards recency bias and expecting the recent past to continue to play out into the future.

Source: Y-charts

Recency bias isn’t always a bad thing; in fact, it can help investors take advantage of a well-documented phenomenon in markets known as momentum i.e., stocks that have performed well in the recent past continue to do well, and those that have performed poorly recently continue to perform poorly.

However, momentum can’t last indefinitely. Eventually, fundamentals take precedence, and when new information emerges or an external shock alters the outlook, the same stocks or asset classes that performed so well can reverse course.

Knowing exactly when that turning point will come or what the catalyst might be is nearly impossible. If we turn back the clock by 365 days, many strategists and forecasters were gloomy about 2024, citing election year uncertainty, sticky inflation, geopolitical concerns as well as the fact that we were coming off a 26% return year in the US in 2023. Those same strategists seem to have been humbled by 2024’s robust returns and are jumping on the rah-rah US stock market wagon – but could they be too late in jumping on the momentum train?

I’ve lost count of the number of times I’ve read about US exceptionalism being the driver of recent strong market returns. Are we looking at ourselves in the mirror a little too much and falling in love with our own reflection? The last time we saw two consecutive years of double digit returns for the S&P 500 was 1998 to 1999…what came after that was the dot-com bust. There are valid arguments for why this time is different; chief among them is that the companies that have contributed to the recent strong market results have revenues and positive cashflows, unlike the fly-by-night internet stocks of the 90s.

Still…I can’t help but think you never get hit by a train you see coming, and that is my worry for 2025. The unknown unknowns that aren’t being taken into consideration as we begin the new year.

With that tempering of enthusiasm out of the way – here are some thoughts for portfolio positioning.

Stay invested

It pays to be an eternal optimist when it comes to the stock market because the history of market returns shows that the stock market goes up more than it goes down, and this is particularly true when you look at longer time frames. So, none of my comments above are intended to be an alarm to sell out of the market; rather, they are meant to be a reality check.

Don’t put all your eggs in one basket

Diversifying your portfolio to include allocations to bonds, small cap stocks, international stocks and alternatives is also important. While each of these segments have lagged the performance of the mighty magnificent seven (resulting in much FOMO), they provide exposure to different drivers of return than US large cap stocks alone.

Rebalance

Rebalancing is an important part of disciplined investing that helps to mitigate the risk associated with too much concentration in any one asset class. With the significant run-up in U.S. large cap stocks, it is a great time to review portfolio allocations and trim back exposures that have gone beyond target allocations, while increasing exposure to diversifying asset classes such as bonds, small cap stocks, international stocks and alternative investments.

Differentiate between trading and investing in your media consumption

Traders look for short-term opportunities in the market to make profits, while investors provide their capital for longer-term gains. Most mainstream media sources report real time on what is happening in markets, which is helpful if you are a day trader, but not as valuable for forming opinions about long-term portfolio positioning for an investor. It is kind of like looking at your fitness device throughout the day for every blip in your heart rate to monitor your fitness instead of zooming out and looking at the trends within the health charts.

As we step into 2025, it’s important to balance optimism with caution. While recent market performance has been impressive and the outlook is positive, history reminds us that corrections and challenges are an inevitable part of investing. Staying diversified, keeping a long-term perspective, and differentiating between noise and meaningful trends are crucial strategies for navigating the year ahead.

1 Source: JP Morgan Guide to the Markets data and Perigon Wealth Management calculations.