It was a difficult first quarter in the market in 2025, and the pain has only worsened in the first weeks of April, with a full-scale global trade war underway.

What has happened so far

On April 2nd, President Trump announced his much-anticipated tariff plans, which were higher than market and economist expectations. The announcement included a 10% blanket tariff on all imports effective April 5th and additional reciprocal tariffs, effective April 9th, on countries where the U.S. runs large trade deficits—notably, a 54% tariff on China, 20% on the European Union (EU), 24% on Japan, 26% on India, and 10% on the United Kingdom (UK). Some countries have announced retaliatory tariffs in the days since and today a 90-day pause on a select group of countries was announced.

Since the announcement U.S. large-cap stocks (represented by the S&P 500 index) at one point declined by as much as 12% skating close to bear market territory, i.e., a decline of 20% or more from the most recent peak, while small cap stock index, Russell 2000, and the tech-heavy NASDAQ 100 index entered bear market territory. Bonds are holding up better than stocks through this turmoil, with the Barclays U.S. Aggregate Bond Index declining just over 1% since the announcement.

A lot has been said and written about the tariffs and how they will impact the economy in both the short and long term. I have thoughts on that as well, but rather than speculate in this letter, I want to focus on what this means for your investments.

The truth is that no one really knows what things will look like in six months or even a year from now. We can assign probabilities to various outcomes and listen to experts talk about how things will play out, but given the sheer number of different parties involved—the U.S. President, foreign governments, businesses, and consumers—it is impossible to know with any degree of certainty exactly how things will transpire.

It is difficult to be in this position, but let’s focus on the things we do know:

Periods of uncertainty are not new to the market

I am not trying to minimize the current situation—I recognize that it is unprecedented and that there is a very serious direct economic and business impact from tariffs. But the fact is, we have weathered “unprecedented” before.

Remember March 2020: there was a global pandemic that brought the world economy to a standstill, oil futures prices went negative, and the stock market hit circuit breakers. There was no vaccine on the horizon and no blueprint for how to navigate it, but we got through that.

Remember March 2022, when Russia invaded Ukraine and inflation started to spike as oil prices rose. Then, the Federal Reserve raised interest rates at an “unprecedented” pace to squelch inflation, inverting the yield curve and raising alarm bells about a recession (that never came). We got through that too.

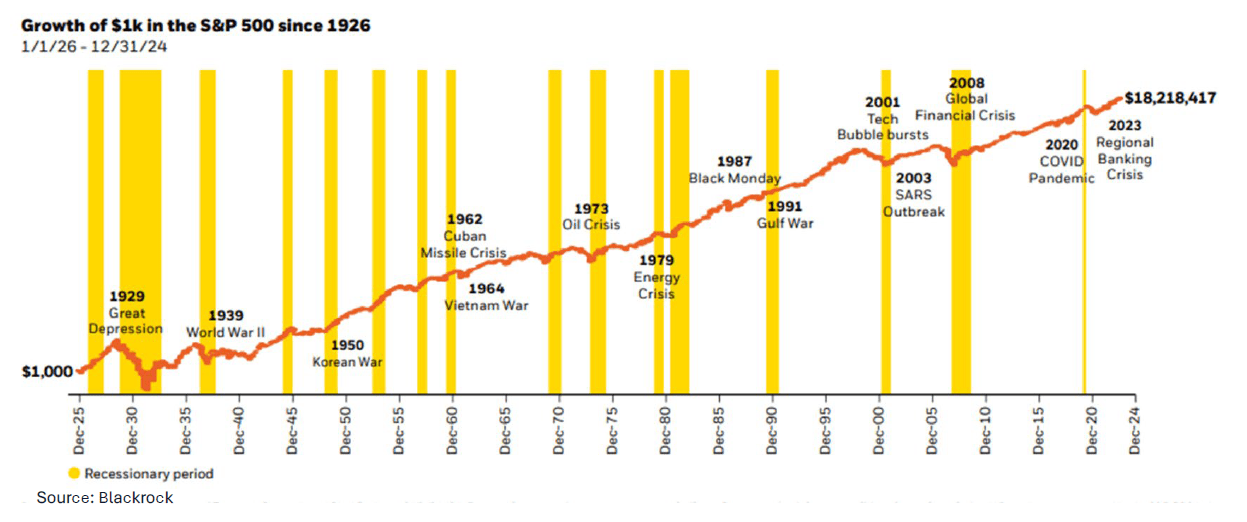

These are just two of the most recent examples, but there are many more as we look further back through the history of market returns. Market declines are an uncomfortable but normal part of investing.

Not only has the market gotten through those prior periods of uncertainty, but it has also gone on to reach new highs after each of those volatile times.

The Stock Market Has Rewarded Long-Term Investors

How can you be certain the market will recover this time?

There are never any guarantees in investing. What gives me confidence is that the stock market comprises thousands of companies across multiple sectors, each focused on making a profit for shareholders. While tariffs change the business environment companies are used to operating in—and may make achieving that end goal harder—there will be companies that successfully navigate this environment, continue to grow, and deliver value to shareholders. There may also be new companies formed as businesses adjust to the new reality.

Stock market leadership changes over time, and when you look at the strong history of U.S. market returns, you see that the companies with the best returns (that propelled overall index growth) have not been the same every decade. What that tells you is that when you invest in the stock market, you are investing in the ingenuity, innovation, and management abilities of different companies. Importantly, you are not just investing in businesses as they operate today, but in the ability of management to navigate the market environment as we move forward.

A case for diversification

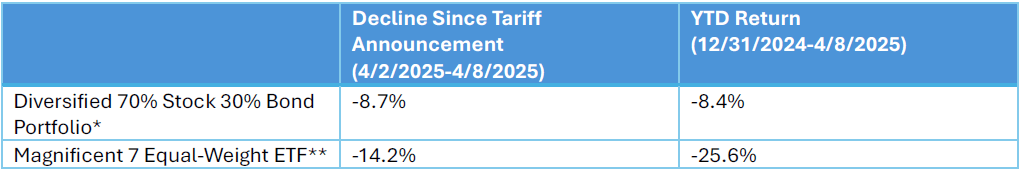

Diversification, especially in this environment, is important—exposure to a broader swath of stocks (both in the U.S. and internationally), as well as bonds, has helped mitigate the sharp 20%+ declines experienced in the largest stocks within the index. Of note, a diversified basket of 70% stocks and 30% bonds has declined much less than an equal-weighted basket of the Magnificent 7 stocks.

* Comprises: 50% iShares Russell 3000 ETF (IWV), 20% SPDR MSCI ACWI ex-US ETF (CWI), 30% Schwab US Aggregate Bond ETF (SCHZ)

**Roundhill Magnificent Seven ETF (MAGS)

Source: YCharts

Patience, resilience, and disciplined investing remain our best prescriptions as we navigate these uncertain times. This is a challenging environment, and we are here to help. If you have questions about your finances or your portfolio, please reach out to your Perigon advisor.