Momentum in global equities continued in July with a 5.28% gain following the 19.2% Q2 return. However, markets continued to show a lopsided rally, with the majority of those gains coming from a handful of the largest names in the U.S. Amazon, Apple, Facebook, and Google parent company Alphabet all reported profits larger than Wall Street expectations. Along with Microsoft, these five names make up almost 12% of the global investable universe and accounted for almost 24% of global equities’ return in July.

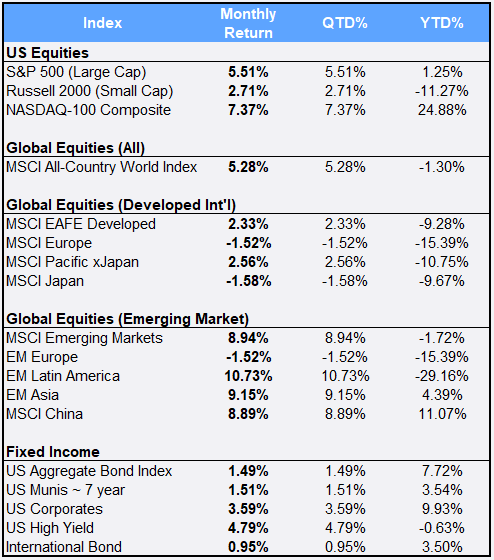

Despite a 32.9% drop in U.S. Gross Domestic Product (the worst quarterly decline in U.S. history) and a quarterly loss of 20 million jobs, the S&P 500 posted its best July numbers since 2010, gaining 5.51% to bring its 2020 return into the black at 1.25%. The aforementioned “Big Five” made up over 38% of the July climb and over 680% of the index’s YTD gain.

Despite a 32.9% drop in U.S. Gross Domestic Product (the worst quarterly decline in U.S. history) and a quarterly loss of 20 million jobs, the S&P 500 posted its best July numbers since 2010, gaining 5.51% to bring its 2020 return into the black at 1.25%. The aforementioned “Big Five” made up over 38% of the July climb and over 680% of the index’s YTD gain.

Utilities were the best-performing U.S. sector in July, gaining 7.81%, while energy was the worst performing, falling 4.91%.

Internationally, both Developed and Emerging Markets rallied 2.33% and 8.94% in July, following impressive Q2 returns of 19.2% and 18.1%. However, both indexes remain in the red for 2020, with YTD returns of -9.28% and -1.72% respectively. China, the largest component in the MSCI EM index, hit an all-time high while gaining 8.89% in July, and accounted for almost 41% of the EM monthly return. China is the best-performing EM country in 2020, up 11.07% for the year.

Fitch Ratings, one of the world’s major credit-rating companies, cut its credit outlook on the U.S. to “negative” on Covid-19 concerns and election uncertainty, but maintained its overall AAA rating on U.S. debt.

Gold hit an all-time high of $1,970.81 per ounce as a weakening dollar and dire economic numbers sparked a rush to safety. Gold’s price gained 10.79% in July, its best monthly performance in nearly a decade.

U.S. bonds continue to rally: The U.S. Aggregate Bond Index gained 1.49% in July to bring 2020 returns to 7.72% YTD. Treasury yields, which move inversely to bond prices, continued lower with short-maturity rates reaching record lows amid investor worries about the pace of economic recovery. The rates on the 3-year and 5-year notes hit new all-time lows of 0.122%. and 0.214% respectively as the Federal Reserve pledges to keep rates near zero until the economy recovers.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of July 31, 2020.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.