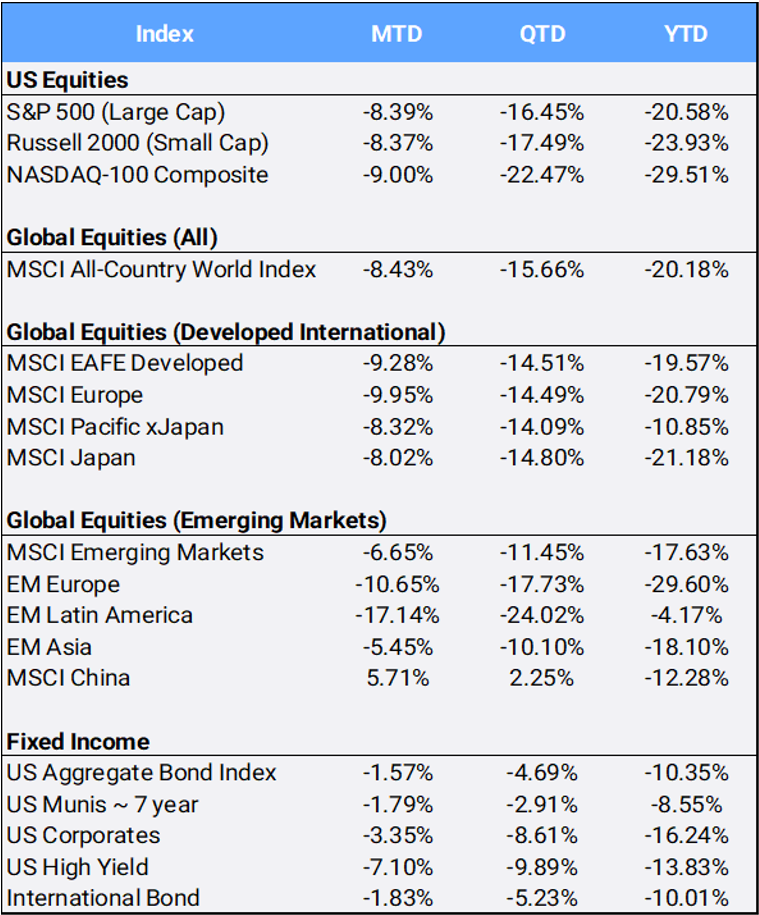

Global equities sold off 8.43% in June to bring quarterly and year-to-date returns to negative 15.66% and 20.18%, respectively. It marked the worst first-half start to a year in the history of the MSCI All-Country World Index, and the first time since the 2008 financial crisis that the index started the year with two consecutive quarter losses. Headwinds for stocks include interest rate increases by central banks across the globe, record-high inflation, gloomy market sentiment, fears of a global slowdown, strict Covid-19 lockdowns in China, and a war in Ukraine that shows no sign of ending soon.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of June 30, 2022

The S&P 500 posted the worst first half of the year since 1970, as the US large cap benchmark dropped 8.39% in June, bringing quarterly and year-to-date returns to negative 16.45% and 20.58% respectively. The tech-heavy Nasdaq Index plunged 22.47% in Q2 and is down 29.51% YTD — its worst first half since the Internet bubble burst in 2001. And the Russell 2000 small cap index fell 17.49% in Q2, bringing YTD returns to 23.93% in its worst first half ever.

Every S&P sector finished the second quarter in the red, and only energy is up for the year, with a 31.76% YTD gain on the back of soaring oil prices. Crude oil posted its ninth consecutive quarterly gain, up 5.76% in the second quarter; it’s up 40.62% for the year. But amid recession fears, the consumer discretionary sector has fallen 32.47% so far in 2022. AMZN posted its worst quarter since 2001, falling 24.84% in a Q2 that saw it announce a stock split and post a surprise $4 billion loss. Shares of the online retailer have tumbled 36.29% so far this year. Another sector laggard was TSLA, which had its worst quarter ever, falling -37.51% in Q2.

The Fed’s preferred inflation measure, the core personal consumption expenditures price index, rose 4.7% and is hovering around levels last seen in the 1980s. The US Federal Reserve raised its benchmark interest rate in June by 0.75%, the largest increase since 1994. Overseas, the dovish Swiss National Bank shocked markets worldwide with a .50% rate increase, its first in 15 years, underscoring the havoc inflation is wreaking in the global economy. (Japan is now the only major developed country not to have raised rates.) The fixed-income fallout: As rates have climbed, all five bond indexes that we monitor in this report have experienced their worst six-month start to a year in their respective histories.

Higher short-term US interest rates raise the opportunity cost of holding gold, which declined 6.72% in Q2 to slip into the red; gold is now down 1.2% for the year to date. The broader Bloomberg commodity index fell 10.77% in June to bring its quarterly return to negative 5.66%; it remains up 18.44% for the year to date, however. Meanwhile, the US dollar continued its climb, appreciating 6.48% in Q2 against a basket of international currencies. The dollar is up 9.42% for 2022 and is trading at 20-year-highs.

European stocks logged their worst quarter since the Covid outbreak, falling 17.73% in Q2, as investors stress over inflation, rate hikes and the Ukraine conflict. Only three of the 48 countries in the MSCI ACWI index are up for the year: Jordan (20.82%), Chile (7.02%) and the Czech Republic (5.96%). Russia, meanwhile, has been wiped off the global equity map in 2022, as index providers deemed its stock market “uninvestable” due to its geopolitical risk. Hong Kong is the best performing market among “developed” nations this year, and even it is down 4.70% YTD. Ireland is the worst developed market, off 36.36% for the year, and Egypt is the worst performing emerging market this year, falling 40.37%.

In style-based indexes, MSCI World Value has outperformed its Growth counterpart both in Q2 returns (Value down 12.89%, vs. 21.01% for Growth) and YTD (negative 14.07% returns vs. negative 28.8%).

Cryptocurrencies have added to the 2022 despair. Bitcoin crashed 41.07% in June to finish the month at $18,371; back in November, it was trading at an all-time of $68,990. The crypto price crash has exposed the highly leveraged nature of the industry and caused a liquidity crunch across companies. Three Arrows Capital, a major crypto hedge fund, fell into liquidation this month as it failed to meet a margin call from BlockFi. And cryptocurrency exchange CoinFlex paused customer withdrawals, citing “extreme market conditions.”

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of June 30, 2022.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”