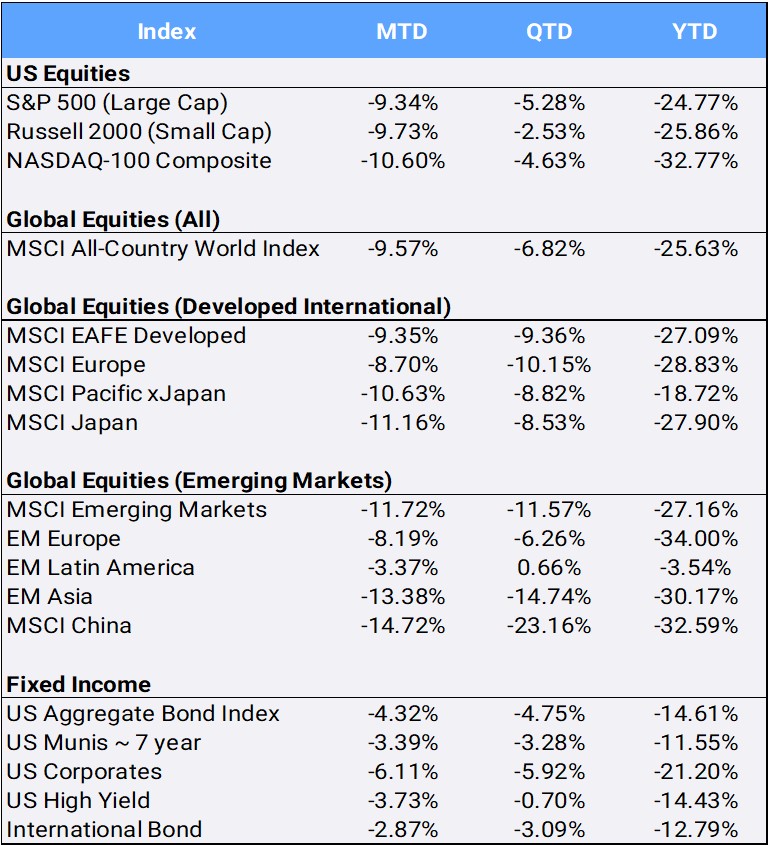

Global Equities fell 9.34% in September in their worst month since the Coronavirus pandemic shook global markets in March 2020 and worst September return since the 2008 global financial crisis. The MSCI All Country World Index sank to a new 2022 low, dropping 6.82% in Q3, marking the first time the global index posted three consecutive quarterly losses since 2009. Year-to-date the index is down 25.63% in its worst nine-month start since its inception in 2001.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of September 30, 2022

Bond markets also sold off violently, as the U.S. aggregate bond index (AGG) fell 4.32% in September to bring declines to 4.75% for the third quarter and 14.61% YTD. International bonds sold off 2.87% in September, down -3.09% in Q3, and -12.79% YTD. Investors increasingly worry that the global economy might tip into recession following successive interest rate hikes by the U.S. Federal Reserve and central banks in Europe and Asia to cool inflation. Announcing the Fed’s third straight 75-basis point increase on September 21, Chair Jerome Powell signaled the intention to continue rate hikes to combat inflation, despite the risk of recession.

Currency markets are in flux thanks to the US dollar trading at its highest levels in 20 years; the greenback appreciated 7.10% in Q3 to bring its YTD climb to a staggering 17.19% against a basket of international currencies.

The Bank of Japan left interest rates unchanged but intervened to support the yen for the first time since 1998. The faltering currency has sent import prices rising, and August core consumer inflation accelerated to its fastest pace in 8 years. In China, monetary authorities were asking state banks to step in and defend its ailing yuan currency even as the People’s Bank of China has reduced its short-term borrowing costs to support its struggling economy amid continued Covid lockdowns.

New U.K. Prime Minister Liz Truss announced a dramatic new economic stimulus plan that included aggressive tax cuts for the wealthy; the British pound dropped to a new all-time low against the dollar, and her government was forced to retreat on the tax cuts. To stabilize the bond and currency markets, the Bank of England abruptly suspended its planned bond-selling program and announced it will instead begin “emergency bond” purchases of its long-dated UK government gilt bonds. On the continent, European Central Bank president Christine Lagarde promised additional rate hikes as Eurozone CPI reached 10% YoY in September.

After Germany reported September inflation accelerated to 10.9%, Chancellor Olaf Scholz said the world’s fourth-biggest economy faces a “double whammy” from skyrocketing local energy prices plus the threat to supplies from suspicious leaks discovered in the Nord Stream natural gas pipelines. European governments continue to deploy extensive funding to ensure natural gas supply: Germany nationalized gas import giant Uniper SE in a government bail-out to avoid the need for rationing, and the Netherlands announced a freeze on gas and electricity prices. While the diversified Bloomberg Commodity Index slipped 4.11% in Q3, it remains up 13.57% YTD. Crude oil prices sank 24.84% in Q3 but remain up 5.69% YTD. Meanwhile, Natural Gas jumped 24.74% in Q3 to bring YTD pricing to an eye-opening 81.39% as winter approaches.

Geopolitical tensions continue to focus on Russia, where President Vladimir Putin announced a “partial mobilization” of 300,000 additional troops in response to Ukraine’s recent battlefield gains, while also hinting at the possible use of nuclear weapons. He also moved to formally annex four Ukrainian territories, a sharp escalation in the war. MSCI Emerging Markets fell 11.72% in Q3 and are down 27.16% YTD. Brazil is an outlier; the local currency, the Brazilian real, has appreciated 7.74% YTD and its stock market has gained 11.53% in 2022 so far, The world’s 10th largest economy heads into presidential elections with both candidates promising more generous welfare and flexible budgets.

Only two sectors posted positive Q3 returns: Consumer Discretionary and Energy gained 3.89% and 1.65% respectively. Energy is the only sector to be in the black YTD, up 33.94%. In contrast, Consumer Services is the worst sector both for this quarter and YTD, falling -11.58% and -11.03% respectively. Real Estate was the 2nd worst Q3 performer, dropping -11.03%. In addition, the S&P Case-Shiller Home Price Index posted its first monthly loss since March 2012; prices eased by 0.4% as potential home buyers face mortgage rates that have doubled in the past 12 months.

U.S. small cap stocks outperformed their large cap counterparts in Q3, falling -2.53% compared to -5.28%. Small caps lag YTD, however, with the Russell 2000 index down – 25.86% against the S&P500 down -24.77%. Global value and growth stocks fell -6.09% and -3.60% respectively in the quarter; For the year they are down -19.30% and 31.04%.

Gold slipped -4.11% in Q3 for YTD returns down -9.22%. While many consider gold a safe haven during economic and geo-political crises, a high-interest rate environment makes the commodity less attractive to investors. The ten-year U.S. government bond yield closed the quarter at 3.83% after beginning the year at 1.51%. Bitcoin, the largest digital currency by market capitalization, gained 3.70% in Q3 and is now down 58.08% YTD.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of September 30, 2022.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”