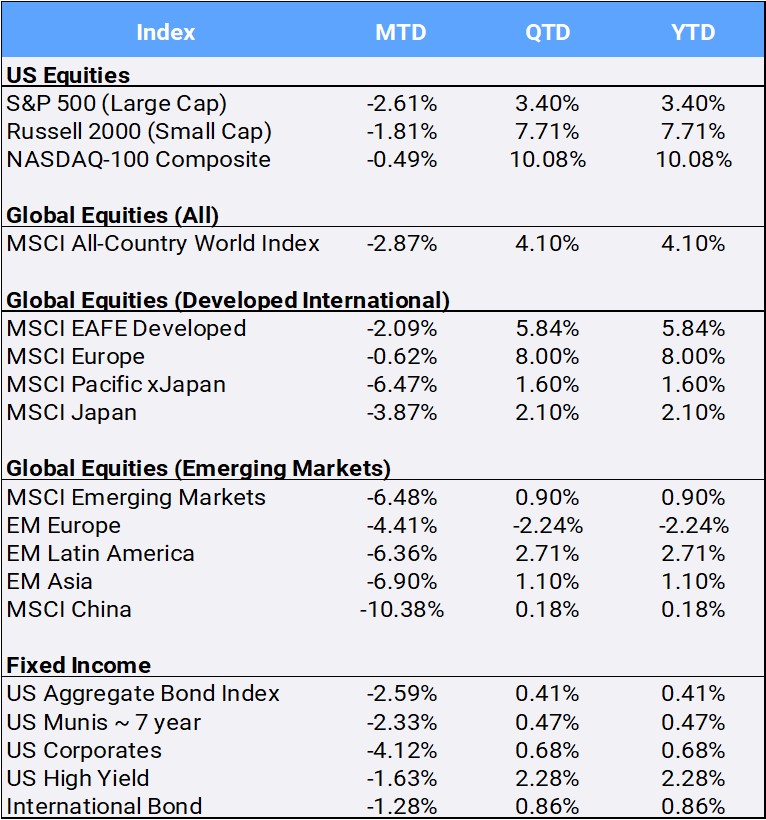

Global Equities roared into 2023 like a lion with the second-best January on record – up 7.17% — but went out like a lamb in February: the MSCI All-Country World Index fell 2.87% as a hike in interest rates and indications from the Federal Reserve that more increases are in store dented investor sentiment for stocks. The market’s “wishful thinking” that the Federal Reserve would soon cease rate hikes or even reverse course is giving way to the reality that stubborn inflation and strong employment numbers mean no such thing. Thus, despite a solid start to the year, all the major indexes posted their second negative month of the past three.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of February 28, 2023

The U.S. Core Personal Consumption Expenditures Price Index (core PCE index) rose 0.6% in January from December, and 4.7% Y-o-Y, a slight uptick from December’s 4.6% and the highest reading since June 2022. In addition, fourth quarter GDP was revised downward to +2.7% from +2.9%. The 10-year U.S. Treasury note hit its highest level since November, finishing February at 3.92%, while the inverted yield curve widened as the 2-year note yield spiked to 4.82%. As yields move inversely to prices, the U.S. Aggregate Bond Index fell 2.59%, marking its worst February return since 1980.

International bonds fell less, down -1.28% in February. Canada’s Consumer Price Index (CPI) eased more than expected in January, while Japan’s core CPI rose 4.2% Y-o-Y in January, above the prior month’s 4% and further pressuring central bank policy. Australian wages grew less than predicted, which could reduce the need for aggressive rate hikes. Finally, consumer and business sentiment improved modestly in the Eurozone, as reduced energy costs due to warm weather have brightened the economic outlook. Europe was an outperforming region in both the developed and emerging market indexes.

China was the largest detractor to international returns this month, as Chinese equities slumped -10.38%. Nearby Hong Kong dropped -7.09% during February; however, equities rallied at month’s end on the announcement by Hong Kong Chief Executive John Lee that the island would drop its mask mandate starting March 1.

Ten of 11 S&P500 sectors finished lower this month, with energy faring the worst, down -6.85%. Technology was the lone sector in the black, eeking out a 0.41% gain. The bellwether Dow Jones Index slid -4.19% this month to drag YTD returns back into the red at -1.48% as February ended. Only three of the 30 industrial names were able to manage gains in February: JP Morgan (2.42%), Apple (2.16%), and Microsoft (0.65%). With almost 94% of the S&P 500 having reported 4Q22 results, average EPS has fallen -5.2% YoY. Despite positive retail earnings, overall Consumer Discretionary earnings have slumped -23.8% YoY and equities in that sector traded down -2.09% in February.

The Bloomberg Commodity Index stumbled -4.70% in February as recession fears escalated. Silver dropped -11.88% in February. Gold, which had touched its best level since April 2022, soon reversed course, ending down -5.26% as strong economic data boosted expectations of more rate hikes that detract from non-yielding assets. The U.S. dollar, in which gold is priced, appreciated 2.72% in February, making gold more expensive for overseas buyers. Strength in the greenback has helped put bullion prices on track for their first monthly decline in four and its worst return since June 2021. Crude oil dropped -2.31% in February, while lumber was the worst performing commodity this month, plunging -23.14%.

Bitcoin, which had plunged 64.22% in 2022, followed its impressive January climb of 37.44% jump by squeaking out a 0.86% gain in February in a wild month of trading. Crypto markets were spooked earlier in the month after what appeared to be the beginning of a potential regulatory crackdown on crypto businesses in the U.S.; the SEC enforcement action against the Kraken exchange and the N.Y. State Department ordering Paxos to stop minting the Binace stablecoin. While regulatory scrutiny is ramping up in the U.S., reports surfaced that Hong Kong is planning to legalize retail crypto trading as part of a bigger push to become a global crypto hub, with quiet backing from China. All this is weighed against the more than $2 trillion of crypto value wiped out last year as speculators fled markets in the wake of frauds and bankruptcies. Perhaps more regulation and scrutiny could be what the market needs to regain investor trust for the year ahead?

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of February 28, 2023.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”