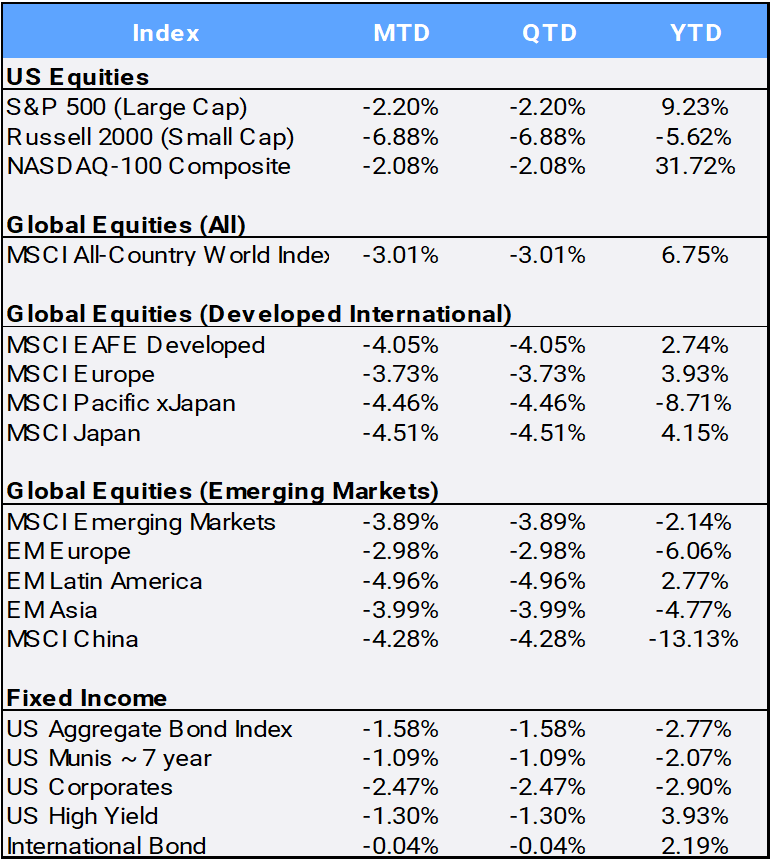

Global stocks represented by the MSCI All Country World Index (ACWI) fell 3.01% in October, the first three-month losing streak for the index since March 2020 when the World Health Organization declared Covid a pandemic. In addition, the benchmark entered correction territory by closing more than 10% below its summer high, but remains up 6.75% YTD. Stocks have been affected by spiking geopolitical tensions due to the outbreak of war between Israel and Hamas, as well as fears that high interest rates will continue thanks to ongoing strong economic data.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of October 31, 2023

In the U.S., the large cap S&P500 index fell 2.20% in October, but small cap stocks in the Russell 2000 index were hit much harder, falling 6.88%. The CBOE Volatility Index (VIX), which projects volatility in stock prices as a gauge of market sentiment, crept up 3.54% to close the month at 18.14 (higher levels can point to increased volatility and fear in the market; the long-run average of the VIX has been around 21) Adding to uncertainty, on October 1st on the brink of a government shutdown Congress passed a bipartisan 45-day stop-gap funding bill (through November 17th) that ultimately cost then-Speaker of the House Republican Kevin McCarthy his job. After three weeks of stalemate, Mike Johnson of Louisiana was finally named as his replacement.

While the S&P500 has gained 9.23% so far in 2023, the average stock in the index has now slipped into the red, indicated by the equal-weight S&P500 index’s (SPW) negative -3.92% YTD return. More indicative of domestic returns outside of large and mega-cap stocks, are the S&P400 MidCap and S&P600 SmallCap indexes, which fell -5.42% and -5.83% respectively in October to pull their YTD returns into the red down -2.63% and -5.83% respectively.

Nine of eleven stock sectors fell in October, with only utilities (up 1.29%) and technology (up 0.09%) in positive territory. Energy was the worst performing sector this month, falling 5.74% as bell weather Chevron missed expectations by a wide margin. Crude oil prices plunged 10.76% in October following its September 8.56% surge, wiping out a full year of returns, as the commodity sits on just a 0.95% YTD gain. The diversified Bloomberg commodity index inched 0.27% higher in October but remains down -3.19% YTD. Gold, however, was able to tick higher in October as it climbed 7.32%, its biggest monthly rise since last November as rising Middle East tensions amid the Israel-Hamas conflict boost safe-haven bets.

Bonds also experienced a “Red October” as the US Aggregate index (AGG) fell 1.58%; at -2.77% YTD, its third-worse ten-month start to a year in the index’s 47-year history. October’s losses come amid a rapid rise in Treasury yields (bond prices move inversely to yields). The benchmark 10-year U.S. Treasury yield breached the key 5% level for the first time since 2007 before backing off and finishing the month up 36 basis points at 4.91%. The yield curve remains inverted, with the 2-year yield closing October up 5 bps at 5.07%. Higher yields are often associated with a slowing economy (hence the recession concerns over the Fed’s campaign of rate hikes), yet US GDP in the third quarter grew a whopping 4.9% driven by strong consumer spending.

Internationally, the European Central Bank gave its clearest signal yet that rates may have peaked, pausing its record run of ten consecutive interest rate hikes. Euro zone inflation fell to a two-year low of 2.9% in October. In Asia, the Bank of Japan jolted financial markets by loosening its grip on bond yields in Governor Kazuo Ueda’s first surprise move since taking the helm, a step that will likely spur talk of potential policy normalization to come. While the BOJ left its short-term lending rate unchanged, the shock came after it said it will allow more flexibility in its yield curve control policy. In emerging markets, weaker-than-expected manufacturing and non-manufacturing activity data in China stoked fears of slowing growth.

Bitcoin surged past $35,000 during the month before finishing October at 34,650, still up 28.80% for the month, buoyed by anticipation of Blackrock potentially readying an exchange-traded fund. The world’s largest cryptocurrency is now up 109.00% YTD after reaching its highest level since May 2022. It is still a long way from its all-time high of just over $67,000 in November 2021.

Looking ahead, it was announced that the leaders of the world’s largest developed market (US President Joe Biden) and largest emerging market (Chinese President Xi Jinping) will meet at the Asia Pacific Economic Cooperation summit in San Francisco in November. It will be the first time the two leaders have spoken in person in a year and Xi’s first trip to the U.S. since 2017.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of October 31, 2023.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”