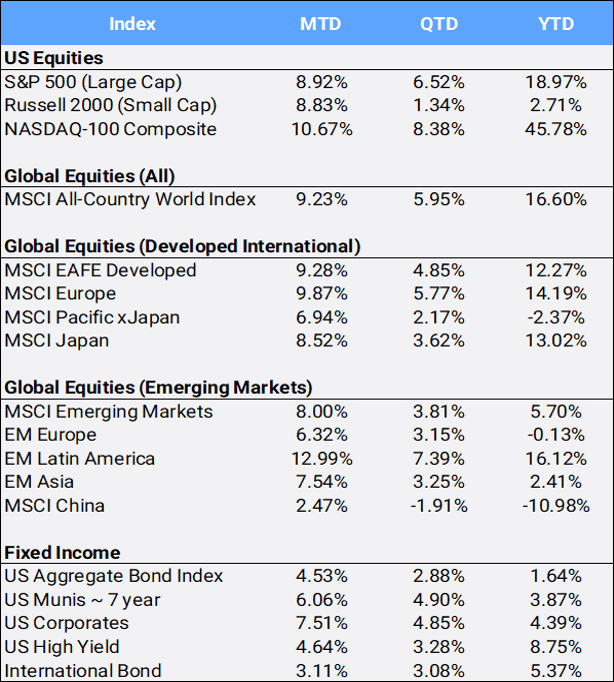

Global stocks surged 9.23% in November, breaking a three-month losing streak in the biggest monthly gain since November 2020; the MSCI All Country World Index (ACWI) has climbed 16.60% YTD and is trading less than 2% away from its 2023 high. Global bonds experienced their best month in 15 years, as the US Aggregate bond (AGG) and international bond indexes rallied 4.53% and 3.11% respectively. The dramatic turnaround in global risk assets came amid growing optimism that most central banks’ next policy moves might be an interest rate cut, possibly as soon as early 2024, following rapid successive central bank rate increases since early 2022 to battle rising global inflation. In addition, recent economic data is firming up the idea of a “soft landing” for the global economy.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of November 30, 2023

The dramatic turnaround in November came as US Treasury yields dropped to 4.33% after touching 16-year highs and surpassing 5% in late October. The benchmark 10-year yield recorded its biggest monthly slide since 2019 while the AGG recorded its biggest monthly gain since the mid-1980s (prices move inversely to yields). Before this “November to Remember” rally, the benchmark bond index was looking at a then-YTD loss of -2.77% which would have represented the third worst annual return in the flagship index’s history, trailing only and 2022’s worst-ever index performance (-13.01%) and 1993’s “great bond selloff” (-2.92%). Instead, November’s rally pulled the AGG into the black at 1.64% YTD.

The US Federal Reserve’s favorite inflation gauge, the personal consumption expenditures (PCE) price gauge, rose 3.5% on a year-over-year basis, slowing from a 3.7% gain in the prior month. Traders of Fed funds futures are pricing in a shift in monetary policy and are now pricing in nearly four rate cuts by the Federal Reserve next year.

In contrast to the bond markets, the CBOE S&P 500 Volatility Index (VIX) touched a 52-week low before finishing the month at 12.92 (after starting the year at 21.67). Referred to as the “fear index,” higher VIX levels as predictors of volatility can indicate greater uncertainty, whereas a lower reading can show complacency. However, it is common for the VIX to ease as equity markets advance, and the S&P 500 large cap index gained 8.92% this month, marking its second-best November since 1980 –second only behind the rebound in 2020. Around 80% of the S&P 500 return this year has come from the “Magnificent Seven” tech stocks: Apple (+46% YTD), Microsoft (+58%YTD), Amazon (+74% YTD), Alphabet (+50% YTD), Nvidia (+220% YTD), TSLA (+95% YTD), and Meta (+172% YTD). However, the “average stock” is up only 4.59% so far in 2023, as indicated by the equal-weight S&P 500 index (SPW). In addition, their “small cap” counterpart, as measured by the Russell 2000, is only up 2.71% YTD.

Ten of 11 S&P500 sectors were higher in November, and stocks that led the rally were generally in sectors most sensitive to borrowing costs: technology (+12.88%), real estate (+9.32%; its biggest gain since October 2011 in the wake of the foreclosure crisis), and financials (+10.92%). Energy was the lone loser, slipping 0.75% as crude oil fell 6.25% in November to $75.96/barrel having started the year at $80.26 and trading as high as $94.17 on September 26th.

Overseas, the Bank of China left its prime lending rates unchanged as policymakers refrained from further pressuring the weakening yuan. In Japan, the National Core CPI came in at 2.9%, still well above the Bank of Japan’s 2% target. Meanwhile, the Bank of Canada was reassured that rates are high enough following October’s cooler-than-expected CPI report. The European Central Bank is balancing an economic outlook that remains “fragile” in its financial stability review, weighing risks of upside inflation and downside growth concerns. Developed global equity markets ranged from Hong Kong (the only down market, slipping -0.02% MTD) to Israel (gaining 16.16%,, thanks in part to a temporary cease-fire in its war with Hamas and an exchange of hostages for prisoners).

Gold marked its second monthly gain on bets that the Fed will pause rate increases, climbing 2.65% in November to surpass $2,000 an ounce. Its precious metals counterparts silver and copper gained 10.62% and 4.46% respectively, and gold miners climbed 11.82% MTD.

Bitcoin climbed 8.95% to close the month at $37,750.77, a YTD surge of 127.70%. It has been a banner year for the world’s largest cryptocurrency in a month that cast its shadow on FTX’s Sam Bankman-Fried’s fraud conviction and additional shady revelations at Binance Holdings. Growing optimism that the SEC will approve an exchange-traded-fund tied to the spot price is driving demand of what traders often refer to as “digital gold”.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of November 30, 2023.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”