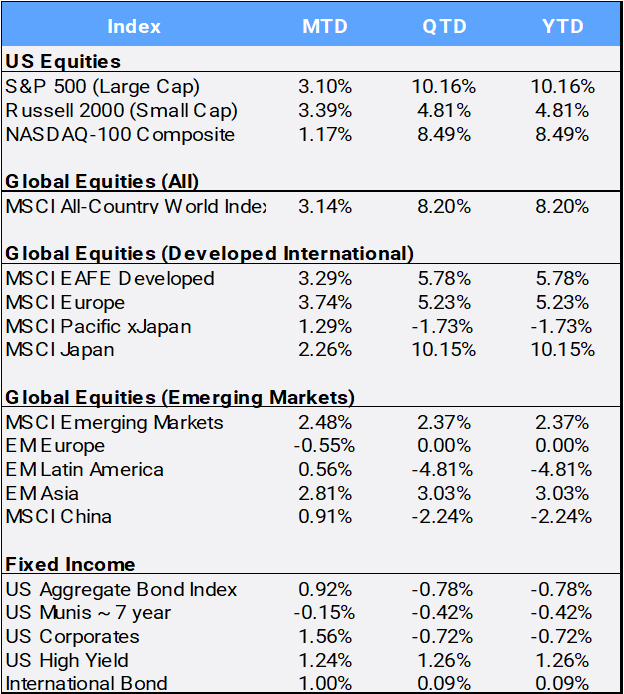

Global stocks closed out March up 3.14%, the fifth straight month of gains with Q1 returns up 8.2%. The MSCI All Country World Index had its best opening quarter return since 2019, and finished March at an all-time high, the 21st of this year. US equities were the global benchmark’s largest contributor to returns. The large cap S&P 500 index continued its onward-and-upward climb, closing out March up 3.10%, up and 10.16% for the quarter, as the flagship US index broke its 5,200 level (with a 5,264.85 intraday high). Energy (13.55%), Communications (12.76%), and Financials (12.46%) led Q1 returns, as ten of the eleven sectors gained during the quarter; Real Estate was the only laggard, falling 0.55% in Q1. The CBOE S&P Volatility Index (VIX), often referred to as “the fear index,” finished Q1 at a mild 13.01, off 2.91% from February.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of March 31, 2024

The “average” US stock, as measured by the equal-weight S&P 500 index (SPW), “only” gained 7.39% in the first three months of the year. While mega-cap tech names continue to dominate the broader global indexes, that concentration is narrowing; last year’s Magnificent Seven (recall 2023’s performance darling stocks of Apple (+48%), Microsoft (+57%), Amazon (+81%), Alphabet (+58%), Nvidia (+239%), Tesla (+102%) and Meta (+194%)) might be reshuffled and relabeled as 2024’s ‘Gang of Four’ with Nvidia, Microsoft, Meta, and Amazon accounting for 47% of the S&P 500 return so far this year. Tesla was Q1’s worst performing S&P 500 name, dropping 29.3% YTD, and Apple has disappointed, declining 10.9%. Meanwhile, last year’s leader Nvidia continues to be a juggernaut as the artificial intelligence frenzy shows no signs of slowing. The stock is the largest single contributor to global market returns, soaring 82.5% QTD and gaining 14.2% in March alone.

US Federal Reserve Chairman Jerome Powell appeared before Congress over two days in early March and acknowledged that a potential “soft landing” exists but warned against assumptions about when the Fed will start its interest cuts, citing the need for more evidence. At its March 20th meeting, the central bank held rates steady and signaled its intent to stick to three rate cuts for the year. In addition, the Fed bumped its 2024 GDP forecast sharply higher to 2.1% from 1.4%, and core inflation estimates rose to 2.6% from 2.4%. With a resilient economy and sticky inflation, policymakers are likely to choose caution over speed. To close the month, Federal Reserve Governor Christopher Waller said there was “no rush” to cut interest rates, given recent economic data indicated that rates may need to stay elevated for longer. Still, the yield curve remains inverted as the US 2-year and 10-year rate closed Q1 at 4.62% and 4.20% respectively after starting the year at 4.25% and 3.88% respectively. As yields and prices move in opposite directions, the US aggregate bond index is off 0.78% YTD.

Overseas, both the European Central Bank and the Bank of England met and left key rates unchanged, while Switzerland became the first developed country to cut interest rates. In Asia, it was reported the People’s Bank of China (PBOC) may restart treasury bond buying, a monetary policy tool it has not used in more than two decades as the country’s real estate sector continues to tumble. The Bank of Japan (BOJ) increased its interest rates for the first time in 17 years, as it moved from a negative rate of -0.10% to 0%-0.10%. The BOJ was the last central bank to have negative interest rates. The Japanese yen hit 151.97 to mark its weakest level against the greenback in 34 years. The US dollar index appreciated 0.32% in March to bring its Q1 gain to 3.11% against a basket of international currencies.

Gold prices closed the quarter at a record high $2,229.87, and logged the best month in more than three years, gaining 9.08% in March, propelled by interest rate cut expectations and strong safe-haven demand. Geopolitical risks have also ticked up, as evident in S&P Global reducing Ukraine’s foreign currency credit rating to ‘CC’ from ‘CCC’ – adding it believes it is a “virtual certainty” the country will default on its external commercial obligations. The Russia-Ukraine war has also impacted global energy infrastructure as crude oil supplies have tightened and prices have spiked to $83.17/barrel, up 13.08% YTD.

Last and speaking of “frenzy,” after Bitcoin’s staggering 152.9% 2023 return, the asset often billed as “digital gold” made an all-time high of $73,835.57 on March 14th and gained 13.39% MTD to bring YTD returns to 66.10% so far in 2024. Perhaps closing a chapter on 2023’s “crypto crisis of confidence”, FTX co-founder Sam Bankman-Fried was sentenced to 25 years in prison for stealing billions of dollars from customers in a case of massive fraud that upended the crypto industry.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of March 31, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”