In the recent weeks, equity markets have seen a 10% decline and interest rates have posted significant declines. The bond and equity markets are not reacting to recent developments as investors have become accustomed to. Buying the dip in equities and trading with the support of central banks are some of the most predictable ways to profits over the last 10 years but these have not been as profitable recently. There could be some valid reasons for uncertainty to remain elevated and for markets to continue in their erratic behavior. Here are three timeless quotes to help process through the noise.

“A Butterfly flaps its wings and causes a hurricane.”

Chaos Theory

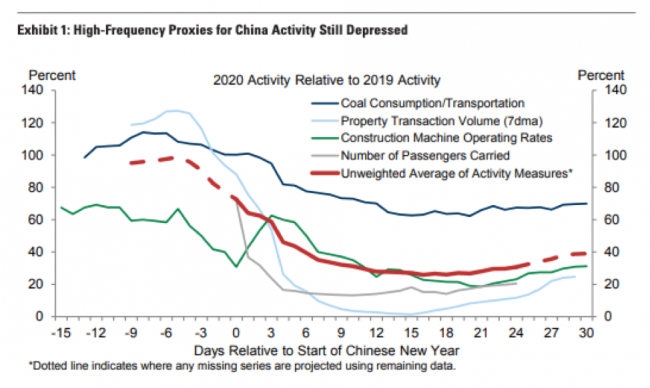

The virus in China has definitely caused significant disruptions to the supply and demand of various goods. Some demand is not going to come back. Consider a cancelled flight will never happen and electrical power not consumed by a manufacturing facility will not be replaced. Other demand is just a backlog. Steel production or semiconductor components that will see a sharp decline but a resurgence once the storm passes. The draconian measures taken by China certainly did cause some disruptions as is evidenced by the graph of electricity consumption in China. There is both lasting damage but also growth that is deferred. Chinese power consumption is illustrated in the image below. The lack of a recovery since the Chinese New Year illustrates the disruption. In addition, many workers are unable to report back to work because of the travel bans in place in China. The recovery of both the supply chain and the demand for services will likely take significant time.

“It’s only when the tide goes out that you learn who has been swimming naked.”

Warren Buffett

Market declines and demand disruptions causes companies that were on the margin to be revealed for their weakness. Any company that was trying really hard for their next funding round could now potentially be unable to find that funding. This goes for both companies seeking venture funding as well as companies issuing debt in the bond markets. Of course, some companies do not have the reserve funds for extended shutdowns. The performance and credit spreads between top tier blue chip companies that can withstand a storm vs more lower tier companies is likely warranted as long as the tide is out. This also suggests that asset classes, sectors and individual companies could see significant performance dispersion when volatility subsides as strong business models that are resilient become more apparent. A rescinding tide is an opportunity to identify resilience.

“Markets are Reflexive”

George Soros

Reflexivity in economics refers to the self-reinforcing effect of market sentiment, whereby rising prices attract buyers whose actions drive prices higher still until the process becomes unsustainable. George Soros applies the term as a way of saying that market prices can move beyond the point of rational pricing. If everyone believes something, it will move past what is rational and eventually, that movement becomes rational. This occurred in the years before the financial crisis. Part of the reason that low documentation mortgages were underwritten was because previous loan losses were extremely small as prices advanced. House purchases were made on the expectation that prices would rise and this actually happened for several years in this positive feedback loop. This was well beyond rational expectations before prices eventually reverted.

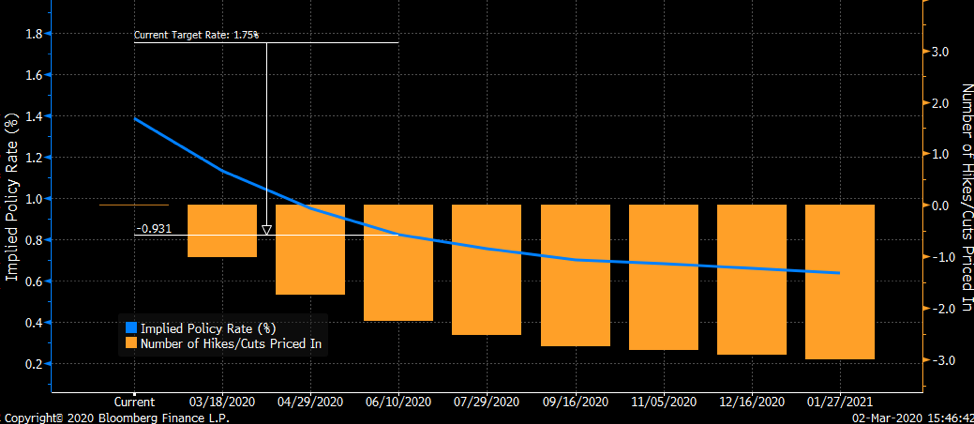

The same reflexive nature applies to a panic sale of assets and the seizing up of the economic engine. As people act in fear, some of which might even be warranted, they are likely to push prices and markets beyond what might be rational. This is illustrated in many areas from purchases of masks and toilet paper to the flight to safety in treasury bonds. Bond markets are now expecting that the Federal Reserve will cut their fed funds target rate by yet another 0.5% in June in addition to the 0.5% cut in fed funds on March 3rd! While this does seem like a sharp drop, US treasury bonds are still some of the highest yielding bonds in the developed World even after their decline over the last four weeks. The reflexive nature of markets could cause extended disruptions. Cancellations of large conferences like Mobile World Congress and Facebook’s F8 are significant. Work slowdowns at large companies are likely to be mirrored by smaller businesses. This negative feedback loop of actions could already be beyond what is rational for a virus that has only a few weeks of data in the U.S. Then again, the feedback loop only stops when it reaches an extreme well beyond what is rational.

What are the actions to take?

- Maintain the long-term view: This too shall pass.

- Balance market risk with assets that are resilient: Asset allocation is important.

- Talk to your neighbor: Resilience does not come from isolation.

Eric Jardine is an investment adviser with Perigon Wealth Management. He has over 15 years of experience investing across the capital markets as an analyst and portfolio manager.