Why you need more than just Nvidia stock in your portfolio today.

2024 has been off to a strong start in the stock market by most measures. A robust US economy, slowing inflation and a cautious Federal Reserve have provided a strong backdrop for continued market growth; but beyond these background factors, optimism around artificial intelligence has been by far the biggest driver of the stock market’s continued ascent this year.

One stock has been particularly important in this rise (enough that I dedicated the title of this article to it). So, I thought it might be helpful to quantify the impact of its growth and address why you might be hearing about it a lot in financial market news lately.

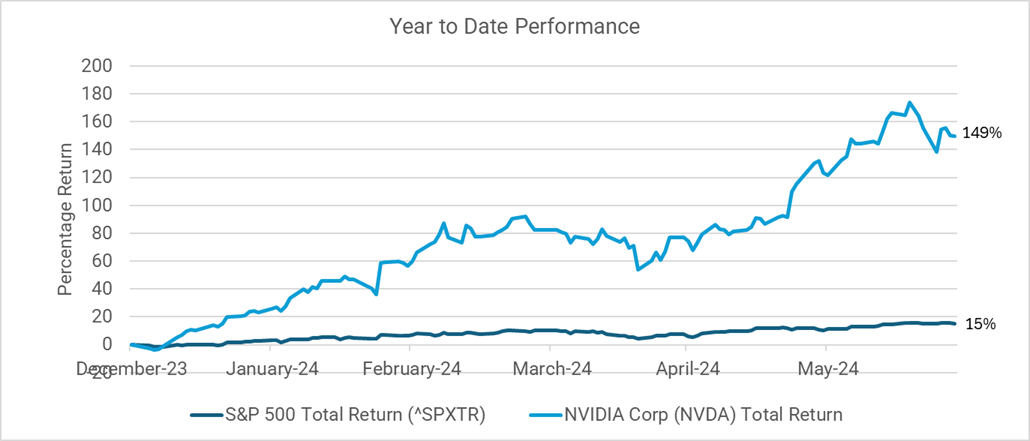

Nvidia’s stock has risen 149% year to date, while US large cap stocks overall are up over 15%1. This one stock alone has contributed to nearly one third of the US market’s return – the next largest contributor is Microsoft which has risen 19% over the same period and accounts for about 10% of the US market’s return1.

Source: Y-charts as of June 30, 2024

Put simply if you didn’t own any Nvidia this year you would have missed out on a good chunk of the market’s return. This is because it has had a strong return and is also one of the largest stocks in the US market. Full disclosure: Nvidia is one of Perigon’s largest holdings as you would expect given its prominence within the overall market2.

But before you get ready to sell out of your diversified portfolio and put all your eggs in Nvidia stock (as some imprudent news articles might be suggesting and can be tempting when you see an almost 150% return over a 6-month time span), it is important to recognize a few things.

Throughout history there have been numerous examples of single stocks and at times groups of stocks that have driven overall market returns. The bottom line is that this is not a new phenomenon, but rather something that is “normal” in markets.

Market leadership changes overtime

Additionally, market leadership changes over time and last year’s winners are not necessarily going to lead the market in the next 12 months or more importantly for the next ten years. A study of the top 10 largest US stocks from 1927 to 2022 showed that after joining the ranks of the top 10 stocks (which is a huge feat and takes significant above-average performance during the years leading up to it), on average those stocks tended to slightly underperform the overall US market return in the subsequent five- and ten-year timeframes3. Sometimes market momentum makes the expectations for a stock too lofty, and it becomes difficult to continue to meet and exceed those expectations into the future.

Artificial intelligence has the potential to transform the way that we work, but the same was true for smart phones in the 2000s and personal computers in the 1990s. The baton of market leadership gets passed on over time and it will no doubt be passed on again at some point in the future. Putting all your eggs in one basket can be dangerous no matter how promising that basket may seem.

With all the press surrounding Nvidia a lesser-known fact is that Super Micro Computer (SMCI), an AI server engineering and manufacturing company, is the best performing stock of the S&P 500 so far in 2024 (up nearly 200% this year) and was also the best performing stock in 2023 (+246%) 4. This example underscores the importance of diversification – in most cases it is hard to know with certainty which stock or set of stocks will present the next greatest opportunity.

FOMO is not an investment strategy

FOMO5 is a powerful emotion, but it isn’t a great investing strategy. Investors who let FOMO get the better of them are often lured in after a stock or investment strategy has already experienced a strong return. These investors often end up chasing their tails and can find themselves jumping from one hot trend to another at the worst time without much to show for it in the way of portfolio growth.

Although the US large cap market is up 15% overall, the average stock in the US large cap market is up just 5% this year6. Not all of those will be winners going forward, but if the hype around artificial intelligence starts to wane or some of the benefits begin to accrue to sectors beyond technology, owning those names in addition to owning the rockstars like Nvidia provides some protection in the face of a pullback or change in expectations.

Even in times of strong market performance, it can be helpful to remember that the key to long term success lies in working with your advisor to build a diversified portfolio that is designed to meet the needs of your specific situation and objectives.

- Source: Y-charts data as of June 30, 2024.

- Note this includes individual stock holdings as well as positions held through diversified ETFs and mutual funds. Source: Goldman Sachs

- https://www.dimensional.com/us-en/insights/magnificent-7-outperformance-may-not-continue

- Source: Y-charts as of July 8, 2024

- FOMO = fear of missing out

- Source. Y-charts as of June 30, 2024. Based on the performance of the S&P 500 equal weight index as of June 30, 2024.