Navigating Market Volatility During Election Season

With less than a month left until election day in a race that is expected to be tightly contested, it is normal to have concerns about how the results will impact you. One topic that garners more headlines than it should is how either candidate winning will impact the market and your portfolio. I am here with a few public service announcements:

- Nobody knows who will win and we might have uncertainty about the results for days after the election

- Policy proposals are just “proposals” and the ability of either candidate to execute on what they are proposing is uncertain

It’s easy to feel like every twist and turn on the campaign trail is a signal to act—but that’s exactly where the danger lies.

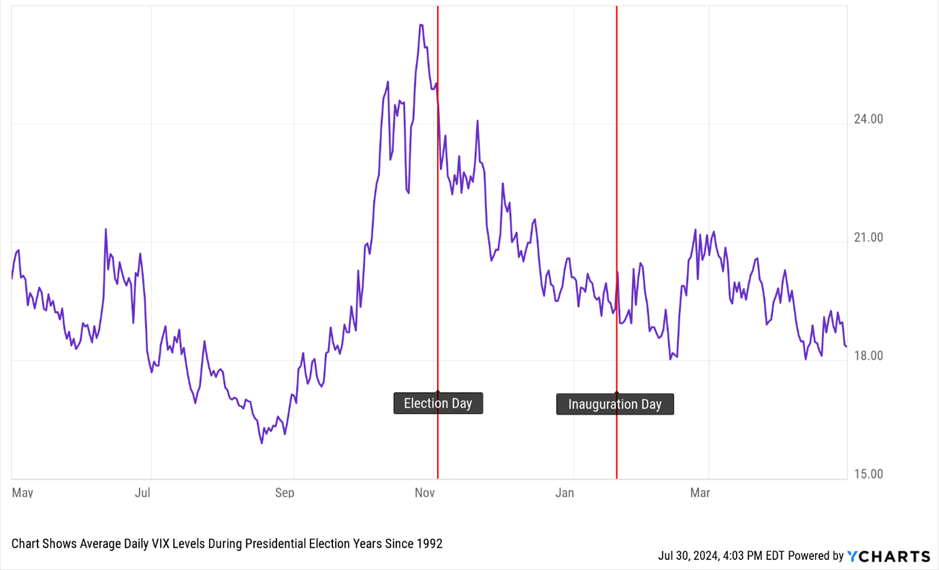

At times like this, it’s crucial to remember that market volatility, particularly during election years, is not new. If we look back at data on market volatility leading up to election day in the past 8 election years since 1992, we know that average volatility as measured by the VIX index (commonly known as the market fear index) tends to rise from September to November (the time period we are currently in) and then declines over the subsequent months as the results are digested leading up to inauguration day.

Average Market Volatility During Election Years

CBOE Volatility Index (VIX)

Source: Y-charts data as of July 30, 2024.

Understanding Election-Year Market Behavior

Historically, markets dislike uncertainty, and elections bring plenty of it. This year has been no exception with two assassination attempts on Donald Trump, a surprise change to the Democrat party candidate from Joe Biden to Kamala Harris and all this occurring against the backdrop of a broadening of the conflict in the Middle East.

But while short-term market dips are common in the run-up to elections, they are often followed by recovery, once election results are clear and policy direction becomes more certain. The key takeaway is this: volatility does not equal loss unless you react impulsively.

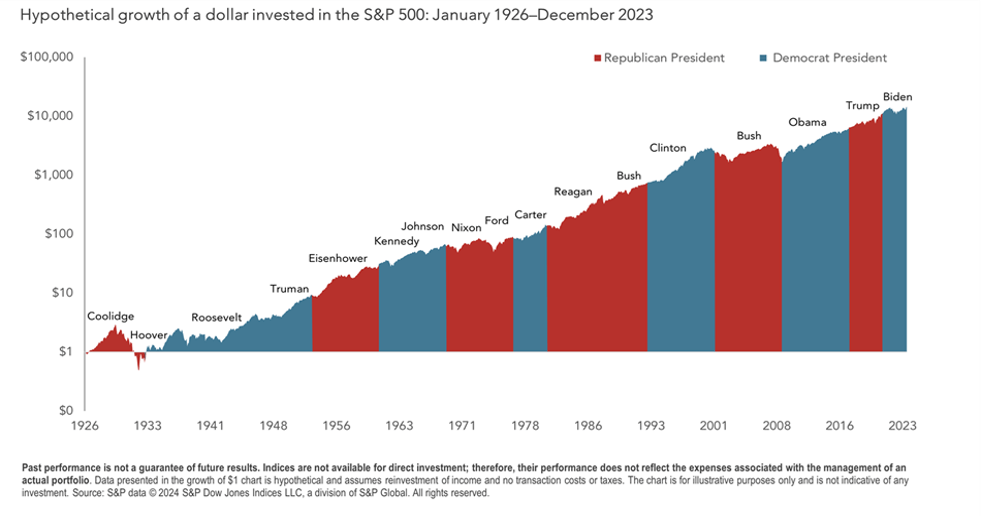

When we look back at the history of market returns over presidential cycles what we see is that the US market has experienced positive returns under both Republican and Democrat administrations. What this means is that investors who stayed invested in the stock market through both Republican and Democrat presidencies would have better returns than someone who moved in and out of the market depending on their favored political party (not to mention the additional tax hit that a market timing investor would pay each time they move out of the market).

History of Market Returns a Helpful Reminder

Source: Dimensional Fund Advisors

Don’t Let Headlines Drive Your Decisions

During election cycles, news outlets tend to magnify uncertainty, which can create anxiety for investors. Whether it’s concerns about changes in taxes, regulation, or economic policy, reacting emotionally to short-term events can derail even the best investment strategies.

Stick to Your Financial Plan

This is where your financial plan plays a crucial role. Your portfolio has been carefully designed with your unique goals and risk tolerance in mind. It’s built to withstand various market conditions, including periods of uncertainty. Staying disciplined during periods of volatility is not always easy, but history has shown that those who stick to their plan tend to be rewarded in the long run.