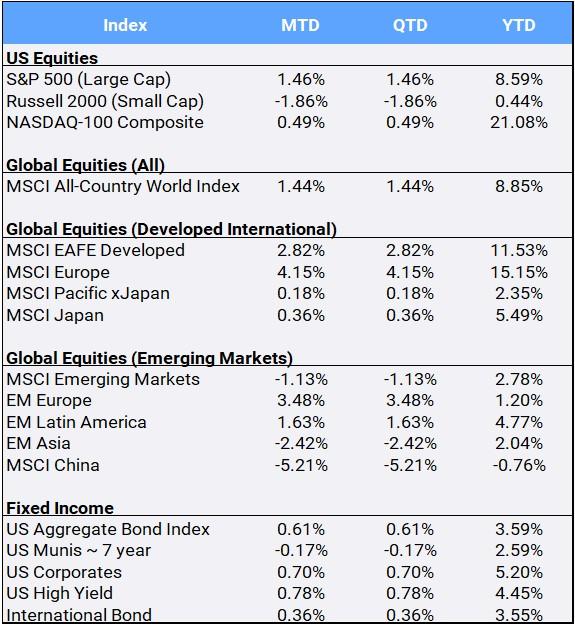

Global Equities gained 1.44% in April to bring their YTD returns to 8.85%. In the U.S., markets were mixed. The Dow Jones Industrial Average posted its best month since January, climbing 2.48%. The small cap stock Russell 2000 index, fell 1.86% in April after a dismal earnings report from First Republic Bank renewed systemic concerns in the financial sector. Still, investors took comfort after stronger than expected large cap technology company earnings and a slight drop in inflation from March– the first since last August. The CBOE Volatility Index (VIX), referred to as the “fear index“, finished April at a complacent 15.78 after spiking as high as 30.81 March 13 – down 27.18% from where it started the year. (The VIX measures anticipated price changes in the S&P500 over the next 30 days, and score above 20 indicate abnormally high volatility).

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of April 30, 2023

Over half of the S&P500 companies have reported Q1 earnings, and thus far, 80% of those have beaten expectations. Consumer Staples were the best performing sector in April, gaining 3.65%; Industrials were the worst, down -1.18%. It should be noted that the S&P500 Financial sector, comprising banks deemed “too big to fail,” gained 3.18% in the month. However, the KBW Nasdaq Bank Index, representing smaller regional banks, declined 0.97% in April. As the month drew to a close, the FDIC placed First Republic Bank under receivership, deciding the troubled regional lender’s position had deteriorated with no more time to pursue a rescue through the private sector.

The core Personal Consumption Expenditures (PCE) Price Index for March rose 0.1%, (+0.3% excluding volatile food and energy) reflecting price increases that continue to slow but at a snail’s pace. The PCE index is a key measure of inflation for the U.S. Federal Reserve, which was anticipated to raise interest rates another 25 basis points at its May 3 meeting. The yield curve continues to be inverted, with the 2-year Treasury closing out April at 4.01% compared to the 10-year Treasury at 3.42%; both were lower than at the start of April. With yields and prices moving in opposite directions, the US Aggregate bond Index climbed 0.61% and international bonds gained 0.36% in April, bringing their respective YTD returns to 3.59% and 3.55%. Last year’s punching bag, the 60/40 portfolio, is up 6.21% so far in 2023.

The U.S. dollar continued to weaken, depreciating 0.21% in April to bring its YTD decline to 0.86% against a diversified basket of international currencies. In addition, international stocks have outpaced U.S. equities since the October lows. The MSCI EAFE Index (MXEA) tracks 21 international developed markets throughout Europe and Asia. It reached another 52-week high and has posted a 32% gain since global markets bottomed out last fall, versus 18% for the S&P500. Some speculate that as the Fed potentially nears the end of its interest rate hiking cycle, dollar weakness may persist – which may continue to lift international equities. On the economic front, the Eurozone narrowly avoided contraction in Q1, with GDP expanding by just 0.1%; Germany’s GDP flatlined over that period. In Asia, the Bank of Japan left policy unchanged but pledged a “broad-perspective review” of easing measures as Tokyo’s consumer price inflation rose 3.5% YoY in April and core prices remained lofty at +2.3% YoY. In another reminder that a country’s GDP can be disconnected from its stock market performance, China’s Q1 GDP expanded by 4.5%– the best growth in a year—yet China’s equity market declined -5.20% in April to drag its 2023 YTD return into the red at -0.76%.

Gold recorded its third straight monthly gain, up 1.05% in April, as renewed concerns over the banking sector’s turmoil, pulled funds into the traditional “safe haven” asset. The Fed issued a detailed and scathing assessment of its failure to identify problems and push for fixes at Silicon Valley Bank before the lender’s collapse, promising tougher supervision and stricter rules. Bitcoin posted its fourth positive month in a row, gaining 3.38% in April, and is now up a whopping 77.06% so far in 2023. However, it has not recovered from last year’s massive declines, down 22.44% YoY from April 2022.

In political news US President Joe Biden announced his bid for reelection in the upcoming 2024 presidential election.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of April 30, 2023.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”