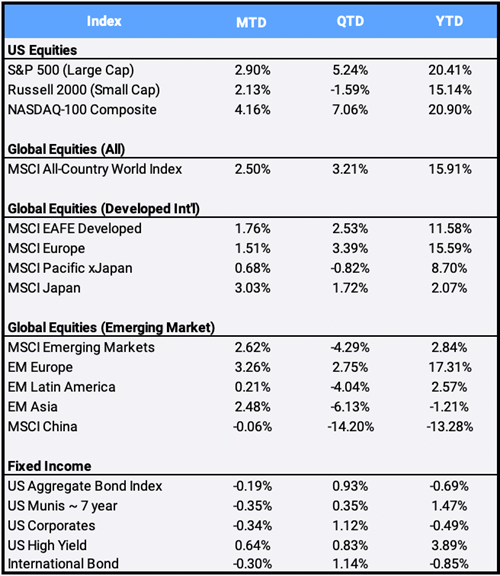

Global Equities gained 2.50% to finish August at their all-time high and to bring YTD returns to 15.91%. In the US, the S&P 500 Index notched its 53rd record close in August, clinching its highest number of records in a calendar year. The US Large Cap stock benchmark climbed 2.90%, its seventh consecutive monthly gain, best winning streak since early 2018 and, with a YTD gain of 20.41%, the strongest January-to-August record since 1997. US equity indexes rallied as investors weighed the tragic events in Afghanistan against more transparency on the Federal Reserve’s monetary policy timeline.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of August 31, 2020

The tech-heavy Nasdaq Index closed the month at an all-time high, gaining 4.16% to bring YTD returns to 20.90%. However, the financial sector was the leader in the hot August rally, gaining 5.14% to become the 2nd best performing sector so far in 2021 with its 31.57% YTD return. The US 10-year bond yield finished the month at 1.309%; notably, it was the widening spread between the U.S. two-year and 10-year yields – seen as an indicator of higher growth and inflation and impacts banks’ profitability – to 110 basis points compared to a spread of 57 bps a year ago – that encouraged investors.

Real Estate gained 2.81% in August to become the best-performing YTD sector, up 32.64% to pass Energy, which slipped -1.92% this month and dragged its YTD returns to 30.52%. Home prices rose 18.6% annually in June, according to the S&P CoreLogic Case-Shiller national home price index. Meanwhile, crude oil prices fell -7.37% this month on demand fears, and Gulf Coast refineries struggled to reopen following Hurricane Ida.

Despite PCE Core Price Index data showing annual price increases at a 30-year high of 3.6%, US Federal Reserve Chair Jerome Powell reiterated his beliefs that higher prices are not broad-based, surge-price categories are moderating and that both wages and long-term expectations don’t suggest “excessive inflation.” He also confirmed that asset purchase tapering is likely to begin later this year, but that interest rate hikes aren’t on the table until the more stringent maximum employment test is met. The broad-based US Aggregate bond market slipped -0.19% this month, and US municipal bonds traded -0.35% lower, to mark the muni market’s first loss since February. US Treasury Secretary Janet Yellen continues to urge Congress to raise the debt ceiling and warns of economic harm should the country’s borrowing capability be exhausted come October.

The MSCI EAFE Index, which is dominated by companies from Europe and Japan, gained 1.76% this month. Germany’s August Purchasing Managers’ Index PMI fell from July but remained solidly in expansion as Q2 GDP grew at 1.6%. The German Business Climate Index dropped for a second straight month in August as exports to China fell -3.9% YoY. Europe’s Consumer Price Inflation, CPI, rose 3% year over year, and the minutes from the ECB’s latest policy meeting noted concerns of understating inflation risks that may or may not be durable.

In the 27-country Emerging Market region marked 2.62% overall in August, thanks to strong growth in Argentina (+30.47%), Thailand (+10.93%), and India (+10.90%); that outweighed Brazil’s August drop of -3.12% and China’s lackluster performance, which slipped -0.6%. Year-to date, Argentina is the best performing market (+38.12%) in the region and Peru is the worst (-26.51%).

In the currency markets, the reassuring words of the Federal Reserve helped steady the US dollar this month, as it appreciated 0.28% against an international basket of foreign exchange, for a YTD gain of 2.50%. Meanwhile, in the cryptocurrency markets, Bitcoin was able to tack on a 13.16% August return, finishing at $47,008.53 and bringing its YTD return to 62.12%. In the past 52-weeks, the asset billed as “digital gold” traded as low as 10,016.81 on 9/5/2020 and as high as 63,410.29 on 4/15/2021.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of August 31, 2021.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”