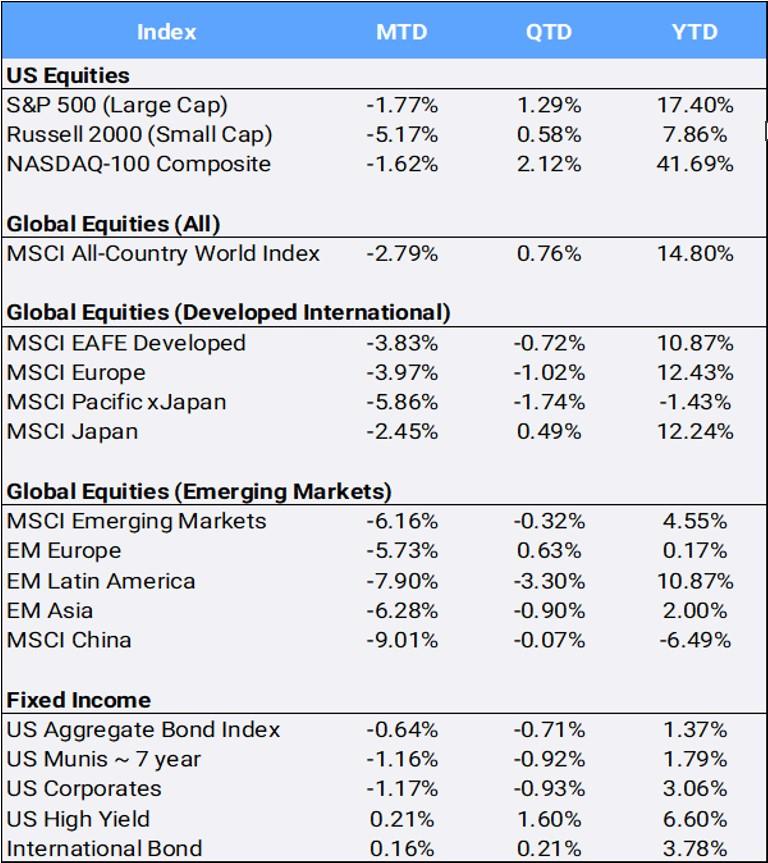

Global equities slipped 2.79% in August, yet the MSCI All Country World Index’s (ACWI) year-to-date gain still stands at an impressive 14.80% over the first eight months of the year. Positive sentiment in risk assets took a hit early in the month following a surprise downgrade of the United States’ long-term credit rating by Fitch, which cited an absence of any political will to deal with the main drivers of the ever-growing US deficit.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of August 31, 2023

After a blistering rally this year that has seen the S&P 500 up nearly 20% by July , the bell weather US index experienced only its second negative month of 2023, falling 1.77% – which was a small “victory” seeing how at one point the index was down almost 6% after the downgrade which would have made it the worst August since 2015. The US bond market was also rattled, as the US Aggregate declined 0.64% in a month that saw the ten-year US treasury rate rise from 3.96% in July to 4.11% in August – after touching a near 16-year high of 4.36% midmonth before pulling back. Yields and prices move inversely to each other.

Fed Chairman Jerome Powell said at the central bank’s annual Jackson Hole symposium that inflation remains too high and indicated that interest rates may go higher still. Investors had previously been hoping that the Fed’s latest interest rate increase in July might have marked the end of the rate-hiking cycle which began in March 2022 with the objective to cool the economy and fight inflation. Still the recent headline PCE deflator showed a year-over-year gain of 3.0%, far below the 7.0% year-over-year gain 12 months earlier. US Q2 GDP was revised to 2.1% down from its original 2.4% growth estimate.

Insurers felt the impact of two unusual natural disasters hitting the US, as historic hurricane Hilary hit California, and wildfires ravaged Maui, Hawaii. The financial sector fell 2.65% in August., Banks as measured by the KBW banking index sold off 8.78% this month and are now trading at their lowest levels since First Republic became the second-largest bank failure in US history back in March 2023. In addition, mortgage applications sank to a 28-year low as rates averaged 7.2%. Bank stocks make up at least 16% of the Russell 2000 small cap index, which saw a decline of 5.17% this month.

Despite the damage among financial stocks, the utility sector was the worst performing sector in August, falling 6.16% to bring YTD returns to another sector worst down 9.31% so far in 2023. Consumer staples was the 2nd worst sector in August and YTD, down 3.94% and 1.22% in those respective categories. More and more retailers, including Walmart, are reporting that their earnings are suffering due to shoplifting as an increased problem and business expense.

Energy was the only positive sector of the eleven this month up 1.65% as crude oil and natural gas prices shot up 2.24% and 5.09% respectively in August. Overall, the diversified Bloomberg Commodity index slipped 0.77% this month to bring YTD returns down 2.77%. Metals also declined as gold, silver, and copper fell 1.27%, 1.23% and 5.04% respectively; expected U.S. inflation and weaker jobs numbers, reinforced expectations that the Federal Reserve will keep interest rates on hold this year despite Powell’s hawkish tone at Jackson Hole.

Overseas, headline inflation in the Eurozone was at 5.1% for August. The European Central Bank is due to meet on September 14th. Since July 2022, the central bank has lifted rates by 4.25%. Of the “Developed” countries in the MSCI EAFE index, Denmark was the only country to post a positive return in August, as Danish stocks climbed 4.34% during the month. Singapore was the worst-performing developed market this month, down 10.06%. In “emerging markets”, Egypt led August country returns up 10.91%, while Colombia was the worst, falling 14.89%. A deteriorating economic picture in China along with the PRC central bank disappointing investors with a smaller-than-expected interest rate adjustment saw Chinese stocks decline 9.01% on the month, bringing their YTD returns into the red at down 6.49% so far in 2023.

In the MSCI All-Country World Index, two US stocks had the largest positive contribution to monthly return: Google (+10.88%) and Nvidia (+10.47%). Nvidia traded at a record high following another blowout quarter and strong earnings guidance that led stocks higher after a rocky start to the month.

Last, the US Court of Appeals sided with Greyscale in a lawsuit against the Securities and Exchange Commission in a decision that may pave the way for a possible spot-bitcoin ETF. Some investors view this as a watershed ETF event on par with the State Street Gold ETF (GLD) that listed back in 2004, giving retail investors access to the shiny metal through a convenient ETF vehicle rather than buying physical gold bars as previously available to them. Despite the exciting news among the crypto-community, Bitcoin, often touted as “digital gold”, fell 10.93% in August. The world’s largest cryptocurrency is still up 56.90% YTD.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of August 31, 2023.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”