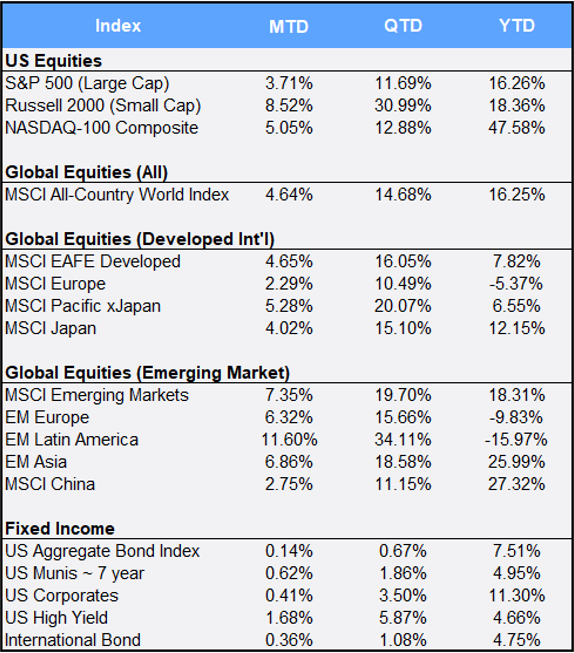

A chaotic 2020 came to a close with global equities climbing 4.64% in December. They ended the year up 16.25%, as the MSCI All-Country World Index (ACWI) finished at an all-time high. The three US bellwethers — the S&P 500, Dow Jones, and Nasdaq — also closed the year at record highs, gaining 3.71%, 3.27% and 5.05% in December and bringing calendar-year totals to 16.26%, 7.25% and 47.58% respectively. It was the Nasdaq’s best annual performance since 2009, though its five largest constituents fueled most of the 2020 gain: Apple +80.74%, Amazon +76.26%, Microsoft +41.04%, Facebook +33.09% and Google +31.03%.

It was a resilient year overall. Equities were rocked in March by the global COVID-19 pandemic, which caused the fastest peak-to-trough slide in market history; global stocks sold off over 33% in 33 days. Yet as governments and central banks stepped in swiftly to backstop credit markets and shore up global liquidity, we saw markets recover in only 148 days — the fastest bounce in market history.

How scared were investors? The CBOE/S&P Volatility Index (aka “the VIX”) started the year at a complacent 13.78, then ramped up to an all-time high of 82.69 in the thick of the pandemic crisis, only to finish the year at 22.75. The fear gauge had hit its previous high of 80.86 mark back in 2008, during the global financial crisis.

US small cap stocks gained 8.52% in December to record their best quarter on record, with a 30.99% increase. For the year, the Russell 2000 was up 18.36% — the first time it has outpaced its large-cap counterparts since 2013.

Top sector returns for 2020 were in Technology (up 43.89%). Energy stocks fell the most for the year (down 32.84%), but still posted the best sector performance for the final quarter, up 28.30%. All 11 sectors rose for the fourth quarter of 2020.

Both developed and emerging markets outpaced their US counterparts in December. The MSCI EAFE and Emerging Markets climbed 4.65% and 7.35% respectively in December, bringing year-to-date returns to 7.82% and 18.31%. International equity returns benefited from a declining US dollar, which depreciated 1.79% this month and 4.20% for the year against a diversified basket of MSCI country currencies.

The declining US dollar also sparked a rally in metals. Gold and silver climbed 6.83% and 16.60% in December to bring 2020 returns to 25.12% and 47.89% respectively — their best annual performance in over a decade. Bitcoin rallied 49.63% in December to close at its all-time high of 28,996 — up 305.07% in an amazing 2020 for the world’s largest cryptocurrency.

Not to be left out of the 2020 rally, bonds also posted slight gains in December (0.14%) and bigger ones for the year (7.51%). The Fed continues its vow to buy bonds until the economy fully heals from the coronavirus crisis.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of December 31, 2020.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”