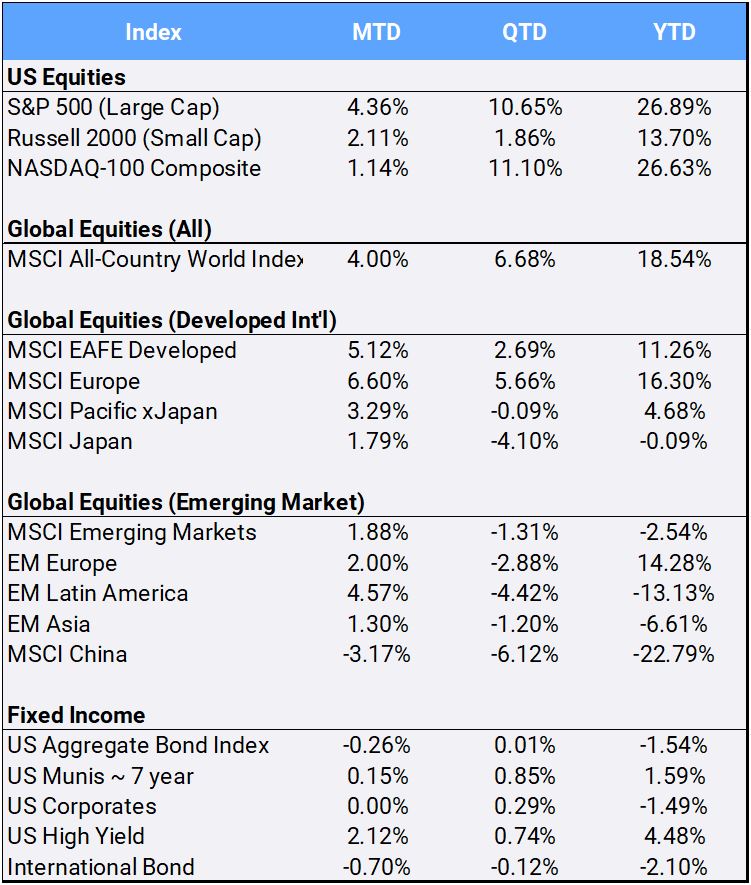

Global equities gained 4.00% in December to finish up 18.54% for the year, their best annual gains since 2019 – notwithstanding the COVID-19 pandemic-induced global recession. The MSCI All Country World Index (ACWI), which comprises U.S., developed and emerging market stocks, closed out 2021 up 18.54%, only 38 basis points off its all-time high on November 16th. Since its launch in1998, the ACWI has returned 8.33% on an annualized basis; in 2021 it racked up 63 all-time highs.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of December 31, 2021

In the U.S., the S&P 500 index notched a 4.36% gain in December to return 26.89% for the year, driven by year-over-year earnings growth rate of 45%, the highest since 2008. The gain marked the large cap index’s sixth best return since 1990. By comparison, the small cap Russell 2000 index lagged, returning 2.11% in December and 13.70% for the year. Value stocks outperformed their growth counterparts in December (5.97% vs. 1.96%), to narrow the 2021 YTD difference (25.37% vs 25.85%) as measured by the Russell 3000 U.S. Total Market Index style categories.

As U.S. stocks climbed, market fear subsided; the CBOE S&P Volatility Index (VIX) eased to 17.22 after beginning the year at 22.75. Also helping was the fact that 2021 was a rare year in which the S&P 500 didn’t have a drawdown of greater than five percent. All eleven Global Industry Classification Standard sectors gained in December and finished 2021 in the black, led by energy (53.43%), real estate (46.20%) and financials (35.04%). The consumer services sector lagged this year, gaining “only” 16.04%.

The U.S. Aggregate Bond Index slipped -0.26% in December to end down -1.54% for the year – marking its worst annual return since 2013 and its second annual decline since the start of the new century. Inflation returned to the top of the news cycle as consumer prices rose 6.8% year-on-year, the fastest annual pace since 1982. To combat inflation, the U.S. Federal Reserve announced it would double the pace of tapering its bond buying to end in March and forecasted three rate hikes in 2022.

In Europe, the Bank of England became the first central bank to formally raise its key interest rate since the onset of the pandemic, as U.K. inflation hit 10-year highs. The European Central Bank further reduced its bond purchases, but asserted it will sustain monetary policy support while keeping rates unchanged. Germany lowered its growth forecast for 2022 as wholesale prices there also experienced record surges. International bonds slipped -0.70% in December and finished 2021 down -2.10% after posting seven straight years of positive annual returns.

In international equities, developed countries as measured by the MSCI EAFE index gained 5.12% in December to return 11.26% in 2021. Emerging markets eked out a 1.88% gain this month, but it wasn’t enough to pull the EM index into the black as it slipped -2.54% on the year. Turkey at -23.53%, Brazil at -23.53% and China at -22.79% had the worst EM returns in 2021. China’s central bank cut its benchmark lending rate for the first time since April 2020 to combat its slowing economy, while the World Bank downgraded its growth outlook for the country. Foreign currencies appreciated 0.72% in December, but depreciated -4.62% against the U.S. dollar this year to weigh on the annual returns of foreign assets.

Global inflation awoke this year, and commodity markets took notice. A diversified basket, as measured by the Bloomberg Commodity Index, gained 3.53% in December to bring its annual return to 27.11% — its largest move since 2000. Oil jumped 13.64% this month to bring it to its largest annual gain (55.01%) since 2009 as global demand recovered from pandemic lows of negative spot oil prices in April 2020. While gold and silver up ticked 2.07% and 3.08% respectively in December, they still ended 2021 in the red, falling -3.64% and -11.72% to post their worst years since 2015 and 2014 respectively.

Last, Bitcoin dropped -18.91 in December, a rocky finish to an otherwise banner year; the world’s largest digital asset was able to manage a 59.79% return in 2021, following its meteoric 305.07% climb the previous year.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of December 31, 2021.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”