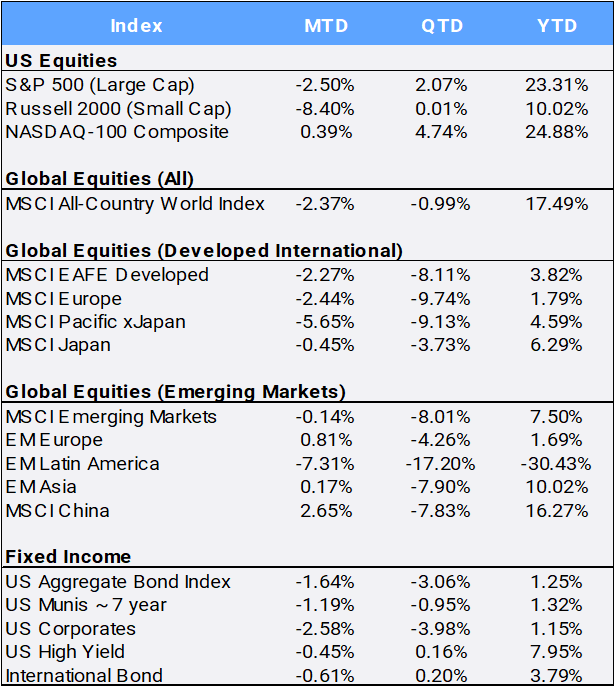

Global stocks ended 2024 on a down note falling 2.37% in December and slipping 0.99% in the fourth quarter, but still posted an impressive 17.49% gain for the year. The MSCI All Country World Index’s (ACWI) finished off just 3.64% from its all-time high it made on December 9th, which was its 58th new all-time high this year. The US was the largest contributor to global returns this year led by investor enthusiasm for rate cuts, economic strength and artificial intelligence. Although the large cap S&P 500 ended on a down note falling 2.50% in December, it rose 23.31% overall in 2024 building on its 24.23% surge from the year prior. Its two-year gain of 52.93% is its best since its nearly 66% rally in 1997 and 1998. Once again, the “Magnificent 7” stocks dominated as the group accounted for 53.1% of the S&P 500’s 2024 total return with annual gains by Apple (+31%), Nvidia (+171%), Microsoft (+13%), Amazon (+44%), and Meta (+66%), Tesla (63%), and Alphabet (+36%). However, the “average stock”, as measured by the equal-weight S&P 500 index (SPW), only gained 10.90% this year. Smaller capitalization stocks, as measured by the Russell 2000 Index, were up more than 21% at their late-November peak before fading into year-end, dropping 8.40% in December to finish 2024 higher only by 10.02%. Still, it was very unusual to see market fears rise in a year that saw such robust stock returns as the CBOE S&P Volatility Index (VIX), often referred to as “the fear index” climbed 28.42% to finish the year at 17.35 after starting the year at a very complacent 12.45. Perhaps as surprisingly, despite the jump in fear, the S&P 500 index did not experience even one correction this past year – that is, a pullback greater than 10%.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of December 31, 2024

The bond market had a wild year, but the Aggregate index was able to manage a 1.25% YTD gain. Had its Q4 decline of 3.06% been an annual return, it would have ranked as the 2nd worst annual return in the index’s history dating back to the mid-1970s. Its 13.01% fall in 2021 was worst annual return, outpacing even 1994’s drop of 2.92% – in what was then known as the “great bond massacre”. As prices and yields move in opposite direction, it was a choppy year as the 10-year treasury yield started the year at 3.88% before jumping to over 4.70% in the spring. It then retreated to below 3.70% in September before finishing the year at 4.57%. Conflicting economic data and changing rate outlooks have fueled those swings. The Federal Reserve made its third and final rate cut of 2024 in their December meeting as the US economy has proven to be stronger than expected at the beginning of the year, but traders have dialed back expectation for further reductions in 2025 as inflation remains above 2%. A promising sign from the bond markets is the “reversion” of the yield curve, as the two-year treasury yield started the year at 3.64% and finished at 4.24%, its first time below the 10-year rate in more than two years.

All eleven sectors posted gains in 2024, with communications and financials leading the way up 34.79% and 30.56% respectively. The materials sector was the laggard, narrowly squeezing out a 0.21% YTD gain after a sector-worst MTD return of -10.78%. Consumer discretionary was the only sector in the black for December gaining 1.14% MTD. In terms of investing “style”, growth stocks in the broad-based Russell 3000 Index significantly outperformed their value counterparts in 2024, gaining 31.57% versus 11.56%, respectively.

International markets did not fare as well relative to the US, with Emerging and Developed markets gaining just 7.50% and 3.82%, respectively, in 2024. Geopolitical factors weighed on international markets this year, as South Korea (martial law), Brazil (swelling deficit), Mexico (tariffs), and France (no confidence vote) were the largest detractors to global markets in 2024 falling 24.49%, 29.77%, 29.55%, and 7.41%, respectively. Taiwan was the largest contributor to global returns outside of the US, gaining 35.07% for 2024, led by Taiwan Semiconductor Manufacturing’s (TSMC) 71.87% increase. TSMC also was the only non-US stock among the top ten MSCI ACWI positive contributors for the year. The World Bank raised its growth forecasts for China’s economy but warned that the real estate downturn will continue to produce headwinds; still Chinese stocks were able to climb 16.27% in 2024, ending three years of consecutive losses.

In currency markets, the US dollar appreciated 6.72% against a diversified basket of currencies in 2024. Gold was one of the best performing commodities, jumping 27.22% YTD in its biggest annual gain since 2010 driven by safe-haven demand and monetary easing by many central banks. It hit an all-time high of $2,790.15/oz on October 31st. Oil prices saw plenty of volatility this year, yet after climbing 5.47% in December, it was nearly unchanged YTD (up just 0.10%) to finish 2024 at $71.72 per barrel. The diversified Bloomberg Commodity Index increased 1.02% in December to bring its annual gain to 5.38% YTD.

Cryptocurrencies saw tremendous growth in 2024, as Bitcoin, often referred to as “digital gold”, skyrocketed from $42k to more than $108k at its high, to finish Q4 with a gain of 46.92% and an eyepopping annual return of 123.47%. It was by far the best-performing asset class of 2024 as new exchange-traded funds ushered in more widespread adoption and hopes for deregulation under a new presidential administration lifted digital assets to record levels.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of December 31, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures or visit our website at perigonwealth.com.”