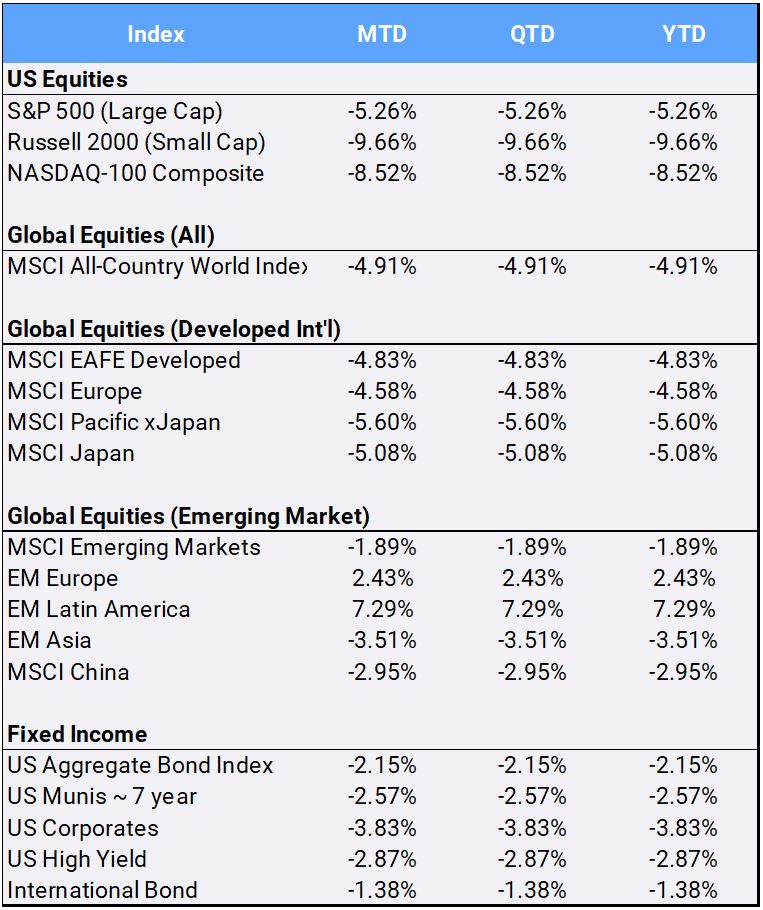

Global markets got off to a rough start in 2022 as the MSCI All-Country World Index fell -4.91% in January, its worst monthly performance since March 2020. The MSCI EAFE index dropped -4.86% and the S&P500 was down -5.26%, while the Russell 2000 Small Cap index dropped -9.66%. Investors have been roiled by volatility and worries about inflation, supply chain issues, upcoming central rate decisions, and geopolitical tensions between Russia and Ukraine. In addition, the International Monetary Fund downgraded its 2022 global growth forecast to 4.4% from 5.9% in 2021, citing slowing growth in the world’s two largest economies, the U.S. and China.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of January 31, 2022

The CBOE Volatility Index – VIX – aka the “fear index,” spiked more than 44% to 24.83. Even bonds were unable to provide relief this month, as both the U.S. Aggregate Bond Index and International Bond Index returned -2.15% and -1.38% respectively. The U.S. Core Personal Consumption Expenditures (PCE) Price Index increased 4.9% in 2021, the highest annual level since 1982. The widely watched U.S. Government 10-year bond yield jumped more than 26 basis points to close January at 1.7767%, as the U.S. Federal Reserve Bank indicated it is likely to raise interest rates for the first time in more than three years to combat historically high inflation. Markets are now pricing in five quarter-percentage-point interest rate hikes in 2022, with the first anticipated in March.

Energy stocks led sector returns after gaining 53.43% last year and continued their momentum with a January increase of 18.81%. The other ten sectors finished the month in the red, with consumer discretionary (-9.45%), real estate (-8.50%), and materials (-6.84%) being the worst. The mega-cap tech-heavy Nasdaq index dropped -8.52%, its second-worst January since the thick of the financial crisis in 2008. The CBOE Nasdaq Volatility Index VXN, which started the year at 21.20, jumped to 30.16 in January, hitting correction territory, and experienced 14 of 23 January trading days with moves of more than +/-1%.

Energy stocks were assisted by crude oil, which posted its best January in 30 years by gaining 17.21% to finish the month at $88.15 a barrel – a level not seen since October 2014. The Bloomberg Commodity Index gained 8.78% in January. Natural gas surged 30.67% in its best January ever, due in part to frigid winter temperatures. Metals, however, slipped as gold, silver and copper returned -1.75%, -3.61%, and -3.11% respectively in January. Following its impressive 2021 return of 59.79%, Bitcoin also lost its shine as it started the New Year with a -17.04% return.

After appreciating 6.73% in 2021, the U.S. dollar continued its march, gaining 0.91% this month against an international basket of major currencies to its highest levels since July 2020. An appreciating dollar weighs on international assets, but global equities were still able to outperform relatively as the MSCI EAFE (developed markets) and MSCI EM (emerging markets) indexes returned -4.83% and -1.89% respectively.

After being the worst performing market of 2021, Brazil led country returns this month, gaining 12.88% as the country recorded its first annual fiscal surplus since 2013. On the opposite end of the emerging market country returns were Korea and Russia, down -10.22% and -9.14% respectively. The U.N. Security Council is set to meet in early February to discuss ongoing tensions amid a build-up of soldiers on Russia’s border with Ukraine.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of January 31, 2022.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”