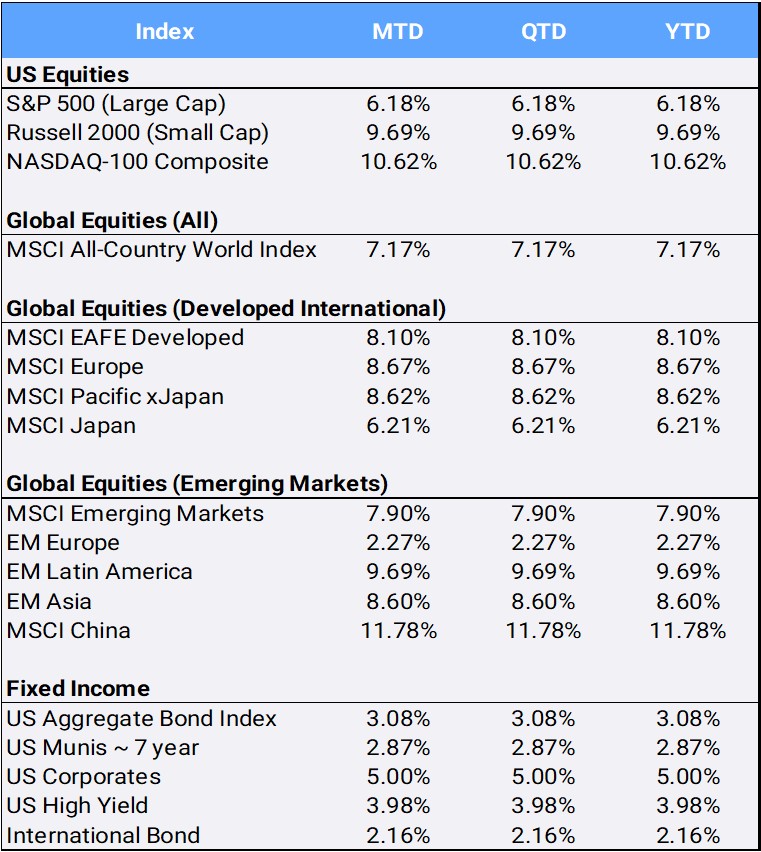

If there is a way to “bounce back” after a brutal 2022 that closed with global equities down -18.36%, it is to come out of the gates strong. Global equities did just that, climbing 7.17% in January. It was the MSCI All-Country World Index’s (ACWI) best January since 2019 and second-best January on record (ACWI dates back to 1998) as global economic data boosted investors’ hopes for a soft landing. Not to be outdone, bonds also shined in January: the U.S. Aggregate Bond index climbed 3.08%, its best January return since 1988. The yield on the benchmark 10-year Treasury closed January at 3.51%, after starting 2023 at 3.87%. Bond yields and prices have an inverted relationship.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of January 31, 2023

Slightly unsettling is the “inverted yield” curve, which has been an indicator of recessions past, as the 2-year treasury yield ended January at 4.20%. As expected, the US Federal Reserve announced a 25 basis point hike at its meeting last week when its meeting concludes in early February. Fed Chair Jerome Powell said the economy’s disinflationary process had started, but cautioned that it was premature to declare victory. He noted that the Fed is talking about a couple more rate hikes to get to the appropriate level, and that he doesn’t expect the Fed to cut rates this year – contrary to market expectations.

Internationally, the Bank of Canada became the first major central bank to say it is halting rate hikes for now after raising its benchmark rate to 4.5% last month, citing recession concerns. The European Central Bank is likely to raise rates by 50bps, while the Bank of England may be divided on how much to hike as it grapples with sky-high inflation and a slowing economy. Finally, the Bank of Japan, which shook currency markets at the end of 2022 by tweaking its long-standing low-yield-curve control policy, is split on how to bring its inflation down; it has commented it would like to see wages rise and increased demand before hiking rates any further. In sum, central banks are walking a wobbly tight rope in balancing efforts to avoid recessions versus bringing down decades-high inflation rates.

In the U.S., 2022 Q4 GDP growth came in slightly above expectations at 2.9%. Consumer spending, which accounts for 68% of GDP, decreased from the prior quarter but remained positive, while inflation readings fell. The Core Personal Consumption Expenditures Index was 4.4% YoY in December, down from 4.7% the month prior and trending in the desired direction.

The Nasdaq Composite, which tanked -32.97% last year, reversed course to gain 10.62% in January – its best opening month since 2001. Nine of 11 S&P500 sectors rose, led by Consumer Discretionary (15.11%) and Communications (14.84%), while Utilities (-2.00%) and Healthcare (-1.87%) lagged. It should be noted that January’s leading sectors were the worst performers in 2022, as Consumer Discretionary and Communications services fell -36.23% and -37.66% respectively—their worst years dating back to 1989. Tesla, whose 2023 decline of -65.03% was the worst in its company history, was the largest positive contributor to global market returns, as it rallied 40.62% in January.

The reversal trend was also evident in international markets. China plummeted -23.60% last year, making it the biggest negative contributor to Emerging Markets. In January, China pivoted to gain 11.78%, on growing optimism about China’s abrupt reopening after three years of strict “zero COVID” lockdowns, to become the biggest positive contributor to EM returns. However, Mexico topped China, as equities rallied 17.01% on growing speculation that US companies might be bringing their supply chain outsourcing “closer to home” in the years ahead.

Crude oil slipped 1.73% in January, while gold rallied 5.72% and hit 9-month highs. The diversified Bloomberg Commodity index fell -0.49% in January following its 16.09% 2022 ascent. The range of commodities within the index was extreme: natural gas plunged -40.02% while lumber soared 40.25% in January. The U.S. dollar depreciated -1.38% against a diversified basket of currencies. Finally, cryptocurrency heavyweight Bitcoin followed the “last to first” storyline, rebounding 38.43% in January after 2022’s crypto bloodbath in which it tanked -64.22%.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of January 31, 2023.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”