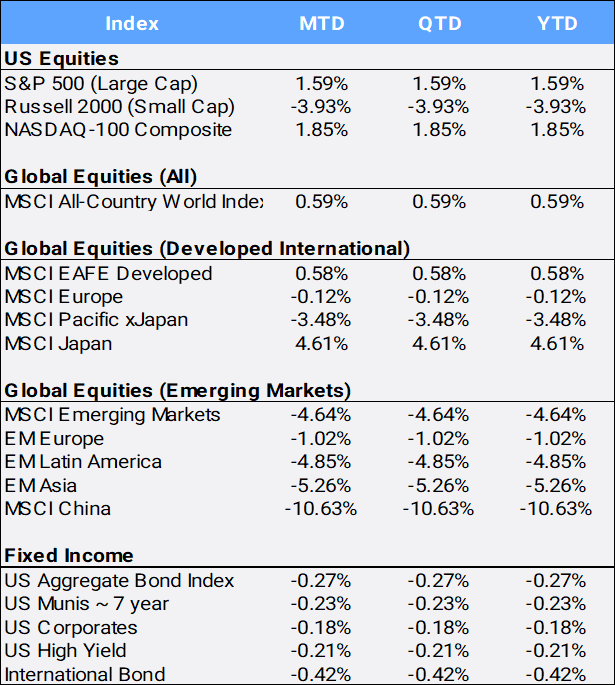

Global stocks gained 0.59% in January, after an impressive run up of 22.2% last year. The US large cap S&P 500 index rose 1.59% in January, posting six new closing highs, after jumping 24.23% last year. The US economy continued to demonstrate strength, with 2023’s fourth-quarter GDP increasing at a 3.3% annualized rate, well above the 2% forecasted. On the inflation front, US core Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred price gauge, rose 2.9% YoY in December, hovering near a three-year low. On a six-month annualized basis, core PCE inflation registered at 1.9%, its second consecutive month below the Fed’s 2% target. Still, the CBOE S&P 500 Volatility Index (VIX), often referred to as the market “fear-gauge”, rose 15.26% to close at 14.35, after starting the year at a very complacent 12.45 reading.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of January 31, 2024

Stock sectors were mixed in January, with five of the eleven gaining in January. The Communications (+4.48%) and Financials sector led (+3.05%), while Consumer Discretionary (-4.40%) and Real Estate (-4.74%) were the laggards. After gaining 15.09% in 2023, Small Cap stocks stumbled 3.93% out of the gates in 2024. Style investing continued its 2023 divergence: the MSCI World Growth Index gained 2.11% (following its 35.95% return in 2023) and the MSCI World Value index only inched up 0.15% (following its 8.67% gain in 2023).

Overseas, the developed MSCI EAFE Index inched up 0.58% in January, after a solid 18.24% gain in 2023. However, the MSCI Emerging Markets index fell 4.64%, after gaining 9.38% last year. MSCI China was the largest drag on index returns, as the country index declined 10.63% in January after falling

13.26% in 2023. A Hong Kong court ordered the liquidation of property giant China Evergrande Group, dealing a fresh blow to confidence in China’s fragile property market as policymakers stepped up efforts to contain a deepening crisis. The People’s Bank of China (PBOC) announced a 50-basis point cut in bank reserves, the biggest in two years. Investors took this as a sign that the PBOC will no longer be passive in supporting the economy. The PBOC also revealed a plan to increase credit to select sectors of the economy and injected 2 trillion yuan ($278B) to purchase shares of Chinese companies.

When the Federal Reserve met on January 31st, the central bank left interest rates unchanged. Chair Jerome Powell noted that a rate cut in March was not likely the “base case” while also dropping a longstanding reference to possible further hikes in borrowing costs. However, there were no hints that a rate cut could be imminent, as Powell noted the Fed would need to see more favorable pricing data before it would lower rates.

Interest rates were mixed along the yield curve, as the US Treasury 2-year rate slipped to 4.21% (from 4.25% at the end of last year) and the 10-year rate inched up to 3.91% (from 3.88%). Still, the yield curve retained its “inverted” status, and the US Aggregate bond index slipped 0.27% this month.

The diversified Bloomberg Commodity index gained 0.40% in January, with oil posting its first monthly gain since September. Crude oil jumped 5.86% to $75.85/barrel as the US and Iran stood on the brink of a more direct confrontation in the Middle East. Iran-allied militants killed three US soldiers in a drone strike in Jordan and hit an oil tanker with a missile in the Gulf of Aden in a series of major escalations adding to geopolitical tensions in the region.

Last, the long-awaited SEC approval for a Spot Bitcoin ETF was announced, and 11 products launched in the US on January 11th. After jumping 152.94% in 2023, Bitcoin added 1.25% in the opening month of 2024 after this key regulatory step, which is anticipated to make it easier for ordinary investors to access the world’s largest digital currency.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of January 31, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”