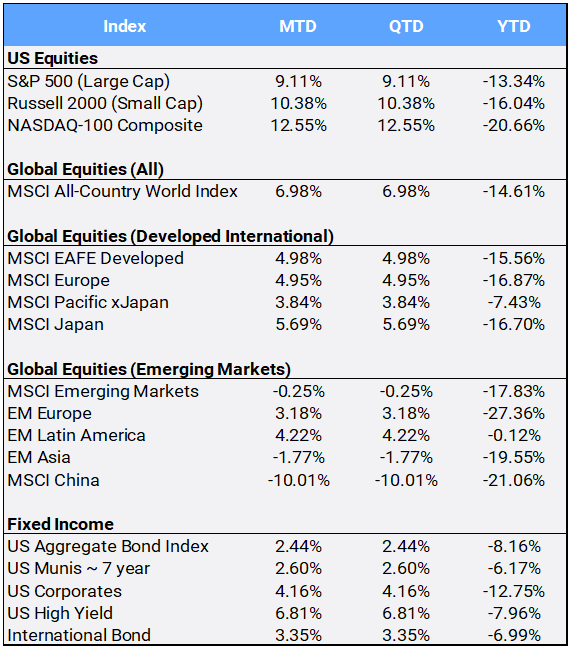

Global equities steamed ahead in July; the MSCI All Country World Index (ACWI) rose 6.98% — its best monthly return since November 2020. That July performance was a welcome contrast from the previous six months when stocks tumbled 22.26% peak-to-trough from January to June – officially entering bear market territory. The July positive trend was attributed to investors’ waning fears about inflation or worries about central banks’ rapid pace of rate increases.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of July 31, 2022

U.S. Gross Domestic Product shrank -0.9% in the second quarter, following the Q1 decrease of -1.6%, meeting the common definition of recession. Despite that, the large cap S&P 500 index was able to post its best July return since 1937, gaining 9.11%. Stellar earnings offset some of the worrisome inflation and GDP reports. More than half of the S&P 500 reported earnings by month’s end with 72% of those beating expectations. Market fears, and volatility, appeared to subside somewhat, as the CBOE S&P 500 Volatility Index (VIX) finished July at 21.33, after spiking as high as 34.02 on June 13th (VIX values greater than 30 are generally linked to large volatility resulting from increased uncertainty, risk and investors’ fear. Values below 20 generally correspond to stable, stress-free periods). The Nasdaq Composite, while still in bear market territory, posted its best July ever, surging 12.55%.

All 11 stock sectors posted gains this month. Consumer Discretionary led the pack, up 18.46%. Amazon jumped 27.06% in its best monthly gain since October 2009, following the e-commerce giant’s report of stronger than expected sales. Technology was the second-best sector, climbing 13.42% in July. Apple gained 18.86% after posting better than expected iPhone revenue. Energy was the third-best sector, up 9.53%. Chevron and Exxon Mobile booked big gains for July, 13.12% and 13.18% respectively, after reporting record profits spurred by steep fuel prices. Crude oil closed at $98.62/barrel, which was off -6.75% in July, but whose price remains up 31.13% YTD.

In the U.S., the core Personal Consumption Expenditures price index (CPE) climbed 6.8%, the highest rate since January 1982, and the Produce Price Index (PPI) rose an alarming 9.1%, its highest annual increase in 40 years. Both are potential indicators that the soaring cost of living may not ease quickly, and that price pressures in the economy remain intense. The US Federal Reserve Open Market Committee (FOMC) raised its benchmark short-term interest rate 0.75% for the second consecutive meeting. However, the FOMC removed forward guidance, saying that its next steps will depend on data released between now and the next meeting in September. Inflation numbers will remain top of mind, but with two consecutive quarters of contracting economic growth, the U.S. labor market will be closely scrutinized for confirmation of recessionary conditions. Jobless claims have been on the rise and high-profile companies (such as Apple, Microsoft, Meta, Amazon, and Google) have revealed hiring slowdowns.

Across the Atlantic, the Eurozone GDP grew 0.7% in Q2, despite inflation reaching another all-time high at 8.9% YoY as the energy supply crisis deepened. The Euro currency’s woes continued, trading at parity with the U.S. dollar for the first time since 2002. The greenback continued its 2022 climb, appreciating 1.22% against a basket of international currencies to bring YTD returns to 10.70%.

In Asia, investors appear to have decided that the yen is weak enough to become a tailwind for Japan equities as exports pick up. In the background, the Bank of Japan remains committed to its yield curve control, with no plans to hike rates, which leaves Japan as the rare stock market not facing the headwind of tightening interest rate policy. In China, growth stalled to just 0.4% in Q2, its slowest pace since 2020, largely due to extreme lockdowns from rising COVID cases. Chinese stocks were the worst-performers in July; the Chinese large-cap index FXI dropped 10.01% in July as geopolitical concerns escalated ahead of a visit by U.S. House Speaker Nancy Pelosi to Taiwan – the highest level U.S. visitor since then-speaker Newt Gringrich’s 1997 visit. China regards with hostility any outside “interference” in what it sees as a renegade province.

The yield on the benchmark 10-year Treasury note eased in July, closing at 2.65% after trading as high as 3.47% on June 14th. As yields move inversely to prices, fixed income across the board rallied and the benchmark U.S. Aggregate Bond Index AGG gained 2.44% this month, following a disastrous first half; YTD returns are down -8.16%.

Bitcoin topped $24,000 briefly, but settled at $23,951.94, up 27.87% for July – its best month since October 2021 and first positive month in the past four. That said, the flagship digital currency is down 48.31% on the year.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of July 31, 2022.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”