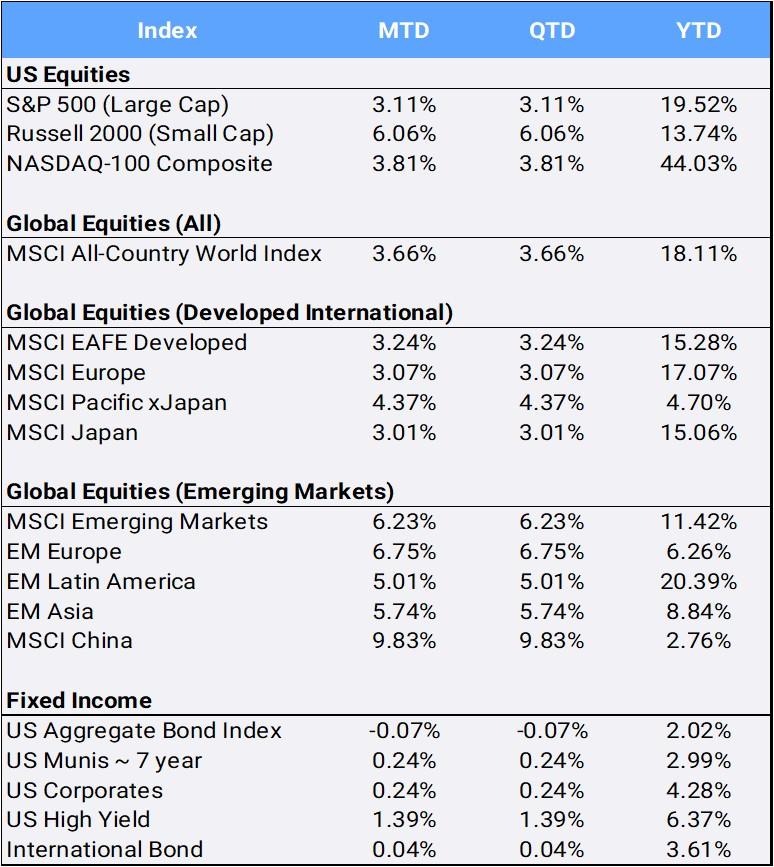

Global stocks added 3.66% in July to bring their 2023 return to 18.11% YTD – marking the MSCI All Country World Index’s (ACWI) best year-to-date gain since 2009 when markets recovered from the global financial crisis. Investors are growing more optimistic thanks to signs that global inflation is slowing, the Chinese government’s pledge to step up support for its economy, and hopes that the major central banks nearing the end of their interest rate hiking cycles. In addition to other supporting economic data, the International Monetary Fund (IMF) raised its global GDP growth estimate up 0.2% to 3.0% for 2023, and after many months of predicting recession, many investors now see hope for a “soft landing” for the global economy.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of July 31, 2023

In the US, the first estimate of Q2 GDP growth came in above estimates at 2.4%, powered by solid consumer spending, while inflation cooled further. The Core Personal Consumption Expenditures (PCE) Index, closely watched by the Federal Reserve, increased 4.1% year-over-year but was at its lowest reading since September 2021. Still, the Fed raised its key interest rate 25 basis points to a range of 5.25% to 5.50% – its highest level in more than 22 years. Going forward, Fed Chair Jerome Powell said the central bank will make data-driven decisions on a “meeting-by-meeting” basis.

With just over half of the S&P 500 companies having reported Q2 results, 80% of them delivered a positive earnings-per-share surprise and 64% a positive revenue surprise. July marked the fifth consecutive monthly gain for both the S&P 500 and Nasdaq indices whose YTD returns now stand at 19.52% and 44.03% respectively. They are down only 4.33% and 4.93% from their peaks at the start of 2022, before the Fed began raising interest rates and the market swooned. The Dow Jones Industrial Average posted a 13-day winning streak, its longest since 1987. Meanwhile, the Russell 2000 index posted a 6.06% gain for July. Constituents in the Russell 2000 include data storage name Super Micro Computer, up 32.51% in July, and artificial intelligence sensation C3.ai , which climbed 15.2%. Still, the small cap index lags with 13.74% YTD return and remains off 17.99% from its record high reached November 2021.

For July, all eleven sectors posted gains with Energy leading at +7.83% and Healthcare bringing up the rear at +1.02%. Crude oil soared 15.80% this month as the global demand forecast improved. Year to date, nine of the eleven sectors have posted gains, led by Communication Services (up 44.14%) and Technology (43.99%). Only Health Care (-0.48%) and Utilities (-3.36%) are in the red so far in 2023.

Global Purchasing Managers Indexes (PMIs), which track trends in the manufacturing and service sectors, continued to expand in the US but showed signs of softening business activity in the UK and Europe. The European Central Bank raised rates for a ninth consecutive time, but noted its sentiment is shifting towards a pause. German inflation fell in July and business sentiment dropped for a third straight month as recession fears persisted. In Australia, Consumer Price Inflation (CPI) slowed to 6% in the June quarter from 7% previously. The Bank of Japan surprised markets by loosening its yield curve control policy, expanding the range for 10-year bonds to 100bps from 50bps around its zero-percent target. Lastly, Canada saw headline inflation dip to 2.8% YoY, landing in the central bank’s target range of 1-3% for the first time in more than two years. Both domestic and international bonds traded mixed in July.

In emerging markets, China’s Q2 GDP growth tumbled to 0.8% from 2.2% the prior quarter as the country faces much different concerns with a -5.4% drop in Producer Prices along with falling exports. Still, hopes ran high for Chinese equities that finished July up 9.83% in its best month since January on an optimistic note as Beijing showcased its determination to shore up an economy that has certainly lost steam. The country’s top planning agency released a wide-ranging document detailing consumption-related initiatives (including automobiles, real estate, and services sectors), while a separate report said that big cities such as Shenzhen and Beijing may ease curbs on the property sector. Of the 24 countries in the MSCI EM index, only one was down in July: Egypt slipping 1.68%. MSCI Turkey was the top July performer, up 19.22%.

Gold prices rose 2.38% in July, and is up 7.73% YTD, as a weaker dollar and expectations that major global central banks are nearing a peak in interest rates boosted investor sentiment. Meanwhile, Bitcoin gave back some of its 2023 gains, falling 3.90% in July. Still, the world’s largest crypto currency remains up +76.17% YTD.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of July 31, 2023.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”