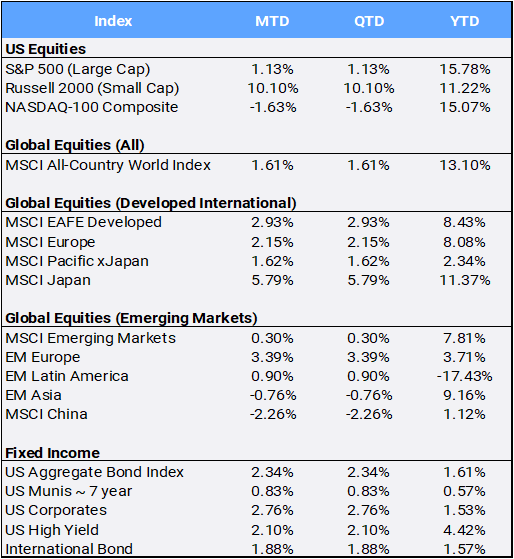

Global stocks, as measured by the MSCI All Country World Index (ACWI), continued their 2024 gains and new closing highs (nine in July and 39 YTD) before finishing a volatile month up 1.61%. ACWI closed at an all-time high on July 17th which saw MTD returns as high as up 3.71% intramonth. However, ACWI traded in the red as late as July 25th until some bottom-feeders came in to lift it to its third month of consecutive gains bringing YTD returns to 13.10%. In the US, the “Great Rotation” got real in July as the broadening out of the rally beyond technology was evident with the Russell 2000 small cap index jumping 10.10% MTD, while the mega-cap tech Nasdaq fell 1.63% MTD and broader S&P 500 gained 1.13%. The 10-point differential between the Russell 2000 and the S&P 500 is extremely rare, as there are only two other ‘ominous’ times when the magnitude has been as strong as this month: February 2000 (an 18% outperformance) and January 1992 (also a 10% differential).

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of July 31, 2024

The Dow Jones traded as high as 41,221.98 as it posted a 4.41% gain for its best monthly gain since December amid investor rotation into cyclical corners of the market. Still, the bellwether lags its other US index peers so far in 2024 with its 8.37% YTD gain. Technology was the only sector in the red for July, declining 3.30% MTD, while real estate, utilities, and financials led monthly sector returns gaining 7.22%, 6.79%, and 6.46% respectively.

After a two-day Federal Reserve meeting closed the month, Fed Chair Jerome Powell said an interest rate cut could be on the table as early as September if inflation moves down in line with expectations, growth remains reasonably strong, and the labor market remains as it is. The Chicago Mercantile Exchange’s “Fed Watch” tool is showing traders pricing in three rate cuts by the end of the year. The US Aggregate bond index gained 2.34% to pull YTD returns positive at 1.61% YTD.

The US dollar depreciated 1.67% against a basket of international currencies in July but remains up 2.73% YTD. The Japanese yen hit a four-month high against the dollar this month after the Bank of Japan raised rates to the highest since 2008 and indicated that more hikes may follow. The BOJ raised the overnight call rate target to 0.25% in its largest increase since 2007, and just months after ending eight years of negative interest rates as the bank’s new lead seeks to dismantle his predecessor’s unorthodox policies. Japan was the largest contributor to MSCI EAFE returns in July, gaining 5.79% MTD while the broader developed market index climbed 2.93%.

China surprised markets twice this month week with interest rate adjustments. First, the country cut benchmark lending rates for the first time in nearly a year as its leadership faces surging debt, potential deflation, and increased trade tensions. Later, China’s central bank conducted an unscheduled lending operation at sharply lower rates to provide more monetary stimulus. Chinese stocks fell— investors feared the urgent action indicated the economy could be in worse shape than previously thought. China was the largest detractor to MSCI EM returns, falling 2.26% MTD while the broader emerging markets gained 0.30%.

The diversified Bloomberg Commodity Index fell 4.04% in July. Energy is the index’s largest component and crude oil finished the month down 4.45% even after it spiked over 4% on the last day of the month after Hamas political leader Ishmail Haniyeh was killed in Tehran. After its parliament accused Israel of carrying out the assassination, Iran’s supreme leader, Ayatollah Ali Khamenei, said it is Iran’s duty to punish Israel. Gold rallied 5.19% in July, as support for the safe-haven asset strengthened amid the threat of conflict escalation in the Middle East, already shaken by the war in Gaza and a deepening conflict in Lebanon.

Bitcoin, often referred to as “digital gold,” rallied 7.39% in July to bring YTD returns to 53.95%. Presidential candidate Donald Trump, who once trashed bitcoin as ‘based on thin air’, was a keynote speaker at a national cryptocurrency conference in Nashville and even proposed building a strategic ‘national stockpile’ of bitcoin –just weeks after he survived an assassination attempt at a rally in Butler, Pennsylvania.

Meanwhile, current President Joe Biden continued to address his poor presidential debate performance on June 28th and was facing calls for him to leave the presidential race. After being diagnosed with Covid, he soon announced on July 21st that he would not be running for re-election, choosing instead to endorse his vice president, Kamala Harris, to be the Democratic candidate. It is going to be an interesting run for all things markets and politics going into November as evidenced by the CBOE S&P Volatility Index (VIX), the “fear index”, ending its summer hibernation by spiking 31.51% MTD to close July at 16.36.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of July 31, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”