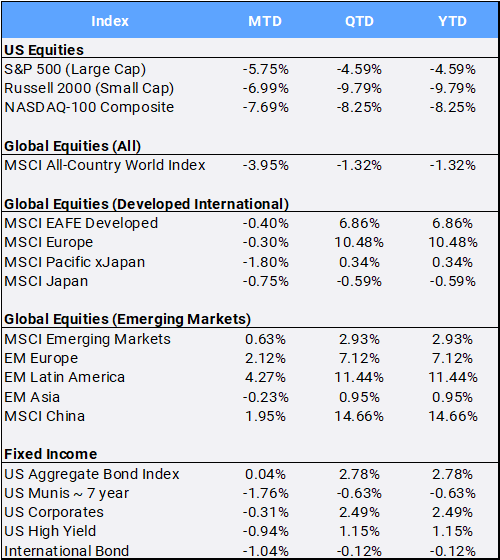

Global equities dropped 3.95% in March to bring Q1 and YTD returns into the red at -1.32%. MSCI All Country World Index’s (ACWI) is 6.59% off its all-time high made on February 12th. US markets contributed 97% of the global markets’ poor performance this month, as the S&P 500 fell 5.75% in February, and posted its worst quarter since 2022 as the large cap benchmark fell 4.59% in the opening three months of 2025. Tariff saber-rattling and firmer inflation shook US equities, as evidence of the CBOE Volatility Index, often referred to as the market “fear gauge”, closed the quarter at 22.28, up 28.41% from where it started the year. This increase is primarily attributable to mounting uncertainty around the Trump administration’s “reciprocal tariffs” plan that would start with all countries coming April 2nd.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of March 31, 2025

The Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE), came in above expectations at 2.80% YoY. While the inflation report wasn’t especially hot, it could keep the Federal Reserve in a holding pattern on interest rates for longer, especially considering the uncertainty regarding tariffs. The global bond markets traded mixed over the first quarter. In the US, the key rates of the US 2-year and 10-year started the year at 4.24% and 4.57%, respectively, and ended Q1 at 3.88% and 4.21%, respectively. Yields and prices move in opposite directions, resulting in US bonds outperforming QTD.

Nine of the eleven sectors posted losses in March, led by Technology (-8.32%), Consumer Discretionary (-8.31%) – which were also the worst performing sectors to start the year with respective Q1 returns of -11.01% and -11.72%. Energy is the best performing sector, both MTD (+3.47%) and QTD (+9.98%). Both Russell 3000 Style indexes dropped this month with Growth faring much worse than Value, as they declined 8.43% and 3.12%, respectively. On the year, Growth is down 10.14% whereas Value is up 1.12%.

US technology has faced significant headwinds since the emergence China’s DeepSeek artificial intelligence startup. In one of the cleverer terms for Q1, the “Mag 7” which benefited from the US AI boom are now repricing as the “Lag 7”. Nivida was the worst contributor to global stock returns as it suffered its worst month since 2022 falling 13.23% to bring its YTD return to -19.29%. Other QTD returns include: Apple (-8.15%), Microsoft (-5.44%), Amazon (-10.37%), Meta (-13.67%), Alphabet (-9.07%) and Tesla (-11.54%) – with the latter as the worst performing Consumer discretionary stock YTD partially due to backlash over CEO Elon Musk’s involvement in the Department of Government Efficiency (DOGE). China was the largest positive contributor to ACWI Q1 returns gaining 14.66% as Deepseek’s AI coverage has boosted other Chinese tech names with QTD returns from Alibaba (+55.09%), Tencent (+18.99%), JD.com (18.04%), and Baidu (+8.59%). The China Internet sector gained 19.34% in Q1.

Gold sailed 9.30% in March and hit a record high of $3,124.07/oz on the final day of Q1 trading to bring its QTD return to 19.02%–marking its best quarter since 1986. This follows the “safe haven” asset’s 27.22% return in 2024. Uncertainty around the US retaliatory tariffs added to the momentum pushing gold higher, in addition to strong demand from central banks, expectations of interest rate easing by the Federal Reserve, geopolitical instability, and increased flows into gold-backed ETFs. Geopolitical uncertainty is high with ceasefires in both the Middle East and between Russia-Ukraine out of reach, as well as President Trump raising geopolitical temperatures with Russia, Iran, Canda, Mexico and Greenland.

There was noticeable news in the subsectors this month. While gold hits all-time highs, gold-miner stocks climbed 15.74% MTD and 35.56% YTD, but remain off over 31% from their all-time highs reached back in September 2011. On the other side of the returns coin is the industry of biotechnology, which is off 9.95% for the year, following their 8.58% March drop after many big biotech and biopharma names came under pressure following the resignation of Peter Marks, the head of the Food and Drug Administration’s Center for Biologics Evaluation and Research. Peter warned in his resignation letter that new Health and Human Services Secretary Robert F. Kennedy Jr has no interest in learning from anyone about vaccine safety and efficacy. Many viewed Marks as the biggest FDA advocate of cell and gene therapies.

Last, Bitcoin, the world’s largest crypto currency, slid 2.13% in March, bringing Q1 returns to -12.05%. This follows an eye opening 2024 that saw the “digital currency” scream 46.92% in Q4 and up 123.47% on the year.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of March 31, 2025.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures or visit our website at perigonwealth.com.”