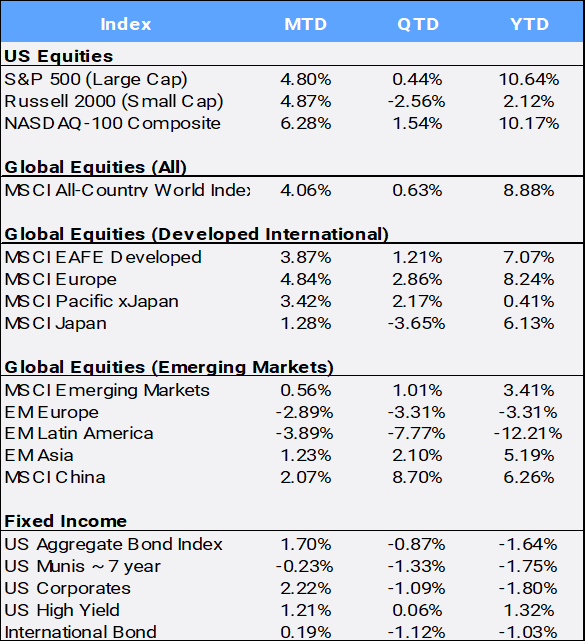

Global stocks rebounded 4.06% in May to overcome April’s -3.30% slump, bringing the MSCI All Country World Index’s YTD gain to 8.88%. The global benchmark for stocks reached seven all-time highs in May, bringing its 2024 tally to 28 record highs so far this year. In the U.S., bell weather indexes hit several milestone levels: the S&P500 index broke above the 5,300 level on May 16th, the Down Jones Industrial Average closed above 40,000 on May 17th, and the Nasdaq composite finished above 17,000 on May 29th.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of May 31, 2024

Ten of the eleven market sectors posted gains this month, compared to just one last month. Utilities, which squeaked out a 1.65% April return, led sector returns in May, gaining 8.97%, followed by Technology’s 7.06% increase. Nvidia was the largest single company contributor to global returns, surging nearly 25% in May following another blockbuster earnings report. Only Energy was down this month, falling 0.42% on the heels of oil’s worst month since last November, as crude dropped 6.03% in May. After spiking to 15.65 in April, the CBOE S&P Volatility Index (VIX), often referred to as the “fear index,” eased 17.44% to 12.92 by May’s end.

As expected, the U.S. Federal Reserve left its key rate unchanged at its May meeting. Chairman Jerome Powell acknowledged hot first-quarter inflation data and noted it will likely take longer than anticipated for the central bank to gain confidence that the economy is on a sustainable path towards its 2% inflation target. He reiterated that the Fed’s current stance is appropriately restrictive. By month-end, Fed funds futures were implying a 50% chance of a September rate cut, with no more than two cuts forecast for this year. Interest rates came in from April as the 2-year Treasury yield fell to 4.87% from 5.04%, and the 10-year slid to 4.50% from 4.68%. Still, the yield curve remains inverted, and both rates are up from where they started the year at 4.25% and 3.88%, respectively. As bond yields and prices have an inverted relationship, the U.S. Aggregate Bond index gained 1.70% in May, but remains in the red at -1.64% YTD.

Overseas, Eurozone inflation came in higher at 2.6% YoY, but the European Central Bank is still expected to lower interest rates at its June 6th meeting. However, services inflation leapt to 4.1% from 3.7%, so additional cuts thereafter may be in doubt. On the credit side, S&P Global downgraded its rating on France’s long-term debt to AA- from AA on May 31, citing the country’s increasingly burdensome debt load. The rating cut serves as a warning to the government that it needs to do more to cut spending, not just seek to boost growth, but it also was a blow to French President Emmanuel Macron’s credibility as a steward of the economy—once a bright spot of his political campaign. International bonds lagged in May, inching up only 0.19% and remain down -1.03% YTD.

The MSCI Emerging Markets index inched 0.56% higher in May but was pulled in two different directions from the larger BRIC (Brazil, Russia, India, China) countries. Brazil was the worst performing EM country, falling 5.02% this month. However, China gained 2.07% as the International Monetary Fund upgraded China’s GDP growth forecast for this year and next by 0.4%. The Biden administration announced new tariffs on $18 billion of goods from China, including quadruple tariffs (to 100%) on Chinese electric vehicles to protect US manufacturers.

Geopolitical tensions increased further in May as Israel launched an offensive against Rafah, Gaza, and the ongoing conflict in Ukraine, and here in the States: a historic guilty verdict against former president Donald Trump – the first former president to be convicted of felony crimes, as a New York jury found him guilty on 34 felony charges in a scheme to illegally influence the 2016 election through hush money payments to a porn star. Trump supporters are threatening retribution and even violence in response in what is shaping up as a turbulent presidential campaign year.

Traditional safe haven Gold posted its fourth monthly gain, rising 1.80% in May, to bring YTD returns to 12.81%. Yet another milestone for the month, the bullion hit an all-time high of $2,449.89/oz on May 20th. In the crypto currency realm, Bitcoin rallied 12.96% in May, after falling -14.05% in April (its worst month since November 2022 and the collapse of FTX Exchange); Bitcoin is up 61.27% YTD.

Lastly, U.S. companies set a record for stock buybacks in May, suggesting strong corporate confidence in future earnings. A total of 154 companies announced $201 billion in planned buybacks; Apple led the charge, unveiling a $110 billion buyback program, the largest on record. American International Group and Lam Research also each announced $10 billion buyback plans.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of May 31, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”