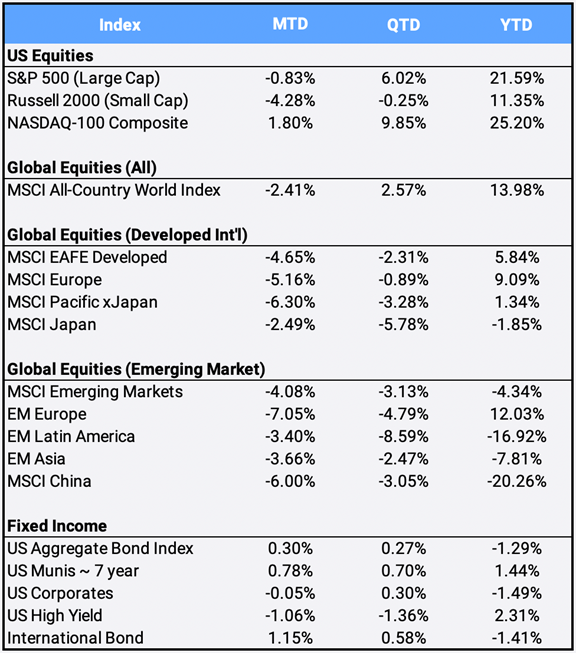

Global stocks hit an all-time high on November 16th only to sell off and finish the month down -2.41% amid fears about the new Covid omicron variant and further impediments to global supply chains. Despite that, the MSCI All-Country World Index is up 13.98% year-to-date. Global bonds inched higher, as the US Aggregate and International Bond indexes gained 0.30% and 1.15% respectively in November, but not enough to end in positive territory YTD as they are down -1.29% and -1.41% respectively. US Federal Reserve Chairman Jerome Powell was reinstated by President Joe Biden this month, but global markets were spooked by his comments that the Fed will discuss an acceleration to the tapering of its bond buying program. Powell also told the Senate banking committee that it is time to stop using the word “transitory” to describe the current inflation environment.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of November 30, 2021

Evidence that inflation is heating up is picking up across the globe. In the US, the core Personal Consumption. Expenditures Price Index increased 4.1% year-over-year, its highest annual level since 1990. Eurozone inflation surged to an annual record of 4.9% in November, with higher energy prices a contributing factor. Consumer prices in Canada rose 4.7% on the year, as the Bank of Canada struck a hawkish tone in its interest rate discussions. In the UK the Consumer Price Index jumped to a ten-year high.

The new Omicron variant, ongoing disruptions in supply chains and the new stance on inflation by the US Fed caused the CBOE Volatility Index (VIX) to close at 27.19 (up from 16.1 on Nov.1st) and extend its largest monthly surge since February 2020. While both the large-cap S&P 500 and small-cap Russell 2000 indexes hit all-time highs during the month, investors sold stocks as fears crept up. The two indexes were off -0.83% and -4.28% in November, yet they are up 21.53% and 11.35% YTD.

Fears of inflationary pressures also spread to the treasury markets, as the CBOE 20-year Treasury Bond Volatility Index (VXTLT) finished at 18.61, its highest close since February. Still, one may look to the currency markets as possible evidence that investors think the US might be preparing for inflation better than other nations across the globe; the US dollar appreciated 1.99% this month against a basket of currencies and is up 6.73% so far in 2021.

Depreciating foreign currencies weighted on international equities, as both developed and emerging market indexes fell -4.65% and -4.08% in November, for YTD returns of 5.84% and -4.34% respectively. China dropped -6.00%, yet is up 20.26% so far this year. The Hang Seng China Enterprises Index is a basket of Chinese stocks that trades in Hong Kong; it closed November at its lowest level since May 2016 as additional government regulations continue to worry investors. The CBOE China Volatility index (VXFXI) closed at 32.97, a 21% “fear premium” to its elevated US VIX counterpart.

A faster Fed tapering off of bond purchases and growing expectations of interest rate hikes were also bad news for Bitcoin. While it closed at an all-time high of 67,734.04 on November 9th, it closed the month down -8.34% to finish at 57,138.67. Still, the asset often billed as “digital gold” remains up 97.06% on the year. Meanwhile, actual gold fell – 0.50% this month, with a YTD return to -6.52%. Last, despite crude oil falling -20.81% in November, it remains up 36.40% on the year, adding to global inflationary pressures as chilly winter months boost energy demand.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940.

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of November 30, 2021.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”