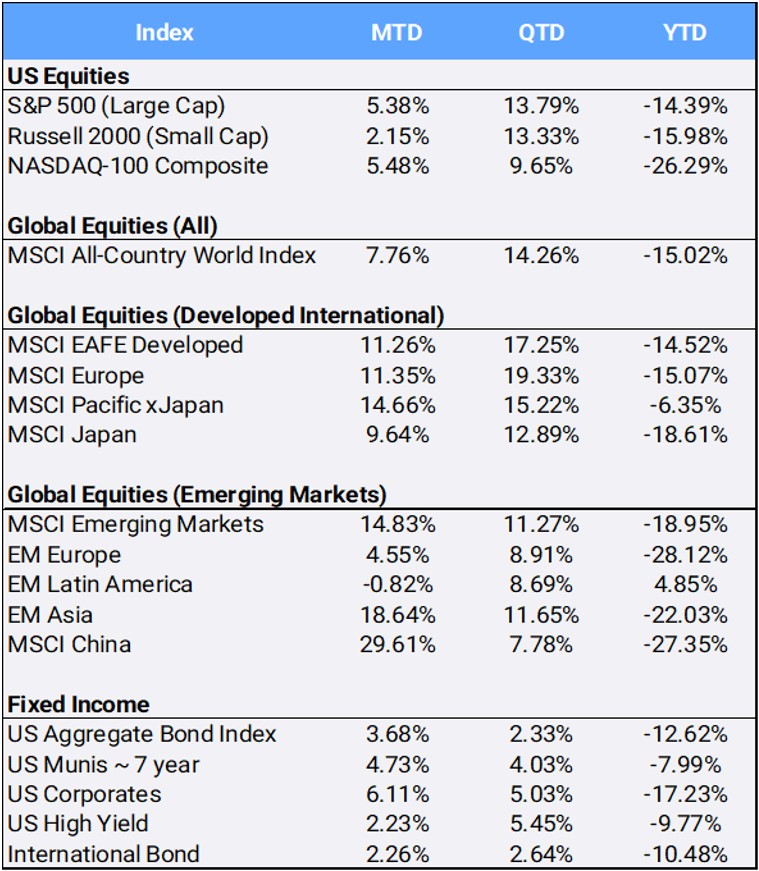

Global Equities marched 7.76% higher in November following October’s 6.03% rally. The MSCI All-Country World Index is now up 14.26% in 2022’s final quarter, but still down 15.02% on the year. Stock prices soared on the final trading day in November after U.S. Federal Reserve Chair Jerome Powell said in a speech to the Brookings Institute that the pace of interest rate hikes will likely slow as soon as its December meeting. However, he also warned that the inflation fight is far from over, reiterating the central bank’s hawkish messaging that its policy should remain restrictive for some time. Still, the slight change in narrative visibly calmed investors, and volatility plunged to a three-month low with the CBOE S&P 500 Volatility “Fear” Index (the VIX) settled the month at 20.58.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of November 30, 2022

In the U.S., the last-day-of-the-month rally was able to pull Nasdaq returns into the black; the tech-heavy large-cap index gained 5.48% in November. The Dow Jones Industrial Average gained 5.67% and is now up 20.41% on the quarter – exiting “bear market” status.

Across the Atlantic, Eurozone inflation slowed slightly in November but remained high at 10.0% YoY. European Central Bank President Christine Lagarde also acknowledged that inflation has still not peaked and the ECB plans to continue with additional rate hikes. Still, global bond markets eased after the violent 2022 selloff; the U.S. Aggregate Bond (AGG) and the International Bond indexes reversed two consecutive losing months by gaining 3.68% and 2.26% respectively in November. Still, YTD those fixed income indexes remain down 12.62% and 10.48% respectively.

Internationally, Developed Markets rallied 11.26%, led by Hong Kong’s 24.03% November return – its largest one-month percentage gain since 1998. Meanwhile, Emerging Markets climbed 14.83%, with China leading the way, gaining 29.61%. The People’s Bank of China (PBOC) cut the reserve requirement for the second time this year, freeing up long-term liquidity for banks to aid the weakening economy. In addition, the S&P China ADR Index posted an eye-popping 40.57% return despite ongoing protests against the government’s strict zero-Covid policy. Near the end of the month, Chinese health officials announced measures to boost vaccination among the elderly, a key indicator seen as important for reopening of the world’s second-largest economy.

After hitting a 20-year high in September, the U.S. dollar declined for the 2nd consecutive month, falling 5.00% in November – its worst monthly return since 2020. Despite that, YTD the greenback has appreciated 10.75% against an international basket of currencies. Meanwhile, gold rallied 8.26% in November to its best month since July 2020 following the recent comments by Fed officials supporting slower rate hikes, which made the non-yielding asset more attractive. With the depreciating dollar making metals cheaper for overseas buyers, silver and copper gained 15.81% and 11.33% .

Overall, the diversified Bloomberg Commodity Index gained 2.74% this month, bringing its YTD return to 19.01%. Natural gas continues to gain, up 9.05% in November, to bring YTD returns to a whopping 85.79%. However, crude oil slipped 6.91%, but it remains up YTD with a 7.10% gain. Lumber is the big laggard, falling 6.98%, and is now down 62.59% YTD.

All eleven industry sectors saw gains for the second consecutive month in a row. Materials led the way in November, up 11.76%. Whereas Energy led in October with its 24.97% gain, this month it was the laggard, up only 1.38% — but was still able to retain ”best performing YTD” status, up 69.70% in 2022. Conversely, Communication Services sector gained 6.88% in November but remains the worst YTD performer, down 33.21% thanks to the challenges to mega-cap stocks Meta Platforms, Alphabet, and Netflix. Those big names have fallen 64.89%, 29.88%, and 49.28% respectively in 2022.

The cryptocurrency world suffered a devastating blow with the abrupt collapse of exchange FTX Group and its sister edge fund Alameda Research, and the unexplained disappearance of potentially more than $1 billion in assets. Bitcoin, the world’s largest cryptocurrency, dropped -16.18% and is now down 63.08% YTD. Contagion from the fallout is spreading: crypto lender and exchange BlockFi filed for bankruptcy because of its exposure to FTX. More than $1.3 trillion of value has been erased from the cryptocurrency market this year, sparked by the failure of the algorithmic stablecoin TerraUSD in May and implosion of hedge fund Three Arrows Capital in June.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of November 30, 2022.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”