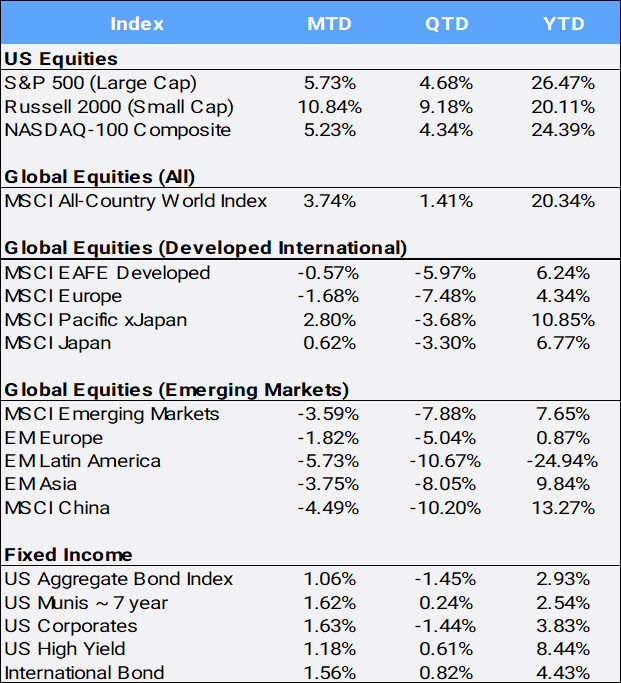

Global stocks closed November at a new all-time high as the MSCI All Country World Index’s (ACWI) jumped 3.74% MTD to bring YTD returns to 20.34% so far in 2024. The US equity market has been a prime driver of global returns, contributing to over 93% of the MTD and 138% of YTD return of the MSCI ACWI benchmark. Without the US participation, the MSCI ACWI ex US index actually slipped 0.91% in November, and would be up only 7.62% YTD. The US stock market move this month largely centered on the post-election rally seen on the back of President-elect Donald Trump’s victory. The bellwether Dow Jones and S&P 500 indexes posted their best months of the year, gaining 5.73% and 7.54% MTD to bring YTD returns to 19.16% and 26.47% respectively. Still, it was the small-cap-focused Russell 2000 that outperformed in November surging 10.84% as investors saw this group benefiting from Trump’s potential tax cuts.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of November 30, 2024

The prospect of a prolonged battle over results was avoided, as Kamala Harris conceded election, acknowledging the stinging loss while still committing to a peaceful transfer of power. The options markets applauded the certainty of the election results as evident by the CBOE S&P Volatility Index (VIX), often referred to as “the fear index”, slumped to 13.51, down from October’s EOM reading of 23.16 just a week before the vote. While the performance of the S&P 500 has impressed as it closed November with its 55th new all-time high of 6,032.38, perhaps as impressive is the fact that it hasn’t experienced a market correction, or a pullback of 10% or more in 2024.

All eleven sectors climbed in November with Consumer Discretionary leading the way with its 12.82% gain, while Healthcare stocks lagged, up only 0.28% MTD. On the year, financials are leading, up 38.06% on hopes of fewer regulations and more merger-and-acquisitions, while Healthcare again is the laggard, down 4.35% YTD. Healthcare’s underperformance has been largely attributed to fears about coming changes in Washington. President-elect Donald Trump picked Robert F. Kennedy Jr. to be his next secretary of the Department of Health and Human Services, adding to a list of Trump’s provocative picks whose confirmation processes will test Senate Republicans.

The US dollar appreciated 1.69% in November and is up 4.35% YTD against an international basket of currencies as investors adjust for the likelihood that the new Trump administration will loosen business regulations and enact other policies that boost growth next year. However, economists also warn that proposed new tariffs and a promised clampdown on illegal immigration could reignite inflation and lead the Fed to adopt a cautious approach to further rate cuts. The CME’s FedWatch tool puts odds of another quarter point cut in December at 66%. The yield curve narrowed this month as the 2-year and 10-year rate closed November at 4.15% and 4.17%, although it has reverted from their inverted levels where they started the year at 4.25% and 3.88% respectively. Trump said he would sign an executive order imposing a 25% tariff on all goods coming from Mexico and Canada, and 10% on imports from China, after being inaugurated on January 20, 2025. The US is the world’s largest importer, and China, Mexico and Canada account for about 40% of the $3.2 trillion of goods it imports each year. MSCI China and Mexico were in the bottom quartile of MSCI Emerging Market returns in November, falling 4.49% and 3.58% respectively.

France was the largest detractor to MSCI EAFE returns both MTD (-4.25%) and YTD (-7.43%). Along with ongoing political turmoil that includes a possible vote of no-confidence amid a longstanding budget dispute, for the first time ever its country’s risk premium drew level with that of Greece. After China, Korea was the largest detractor to MSCI EM returns both MTD (-5.73%) and YTD (-18.33%). It was its 8th monthly decline in 11 months – Korean stocks have not seen such a persistent losing streak, even during the 1997 Asian financial crisis and the 2008 global financial crisis.

Gold fell 3.67% in its worst monthly slide since September of last year, as “Trump euphoria” lifted the dollar and stalled gold’s record rally. Gold, buoyed by geopolitical tensions and Federal Reserve interest rate cuts earlier this year, now faces pressure as higher tariffs could stoke inflation and lead the Fed to adopt a cautious approach to additional rate cuts. Still, the traditional safe-haven asset remains up 28.12% YTD. Geopolitical tensions sharpened at the end of the month as Israel’s military reported a possible ceasefire breach with Hezbollah, while Russia launched its second major attack on Ukraine’s energy infrastructure. Oil fell 1.82% in November to bring its YTD return to down 5.09%.

Meanwhile Bitcoin, the asset known as “digital gold”, rallied 39.35% this month to bring its YTD return to an eye-popping 132.41% as the flagship cryptocurrency hit new records and nears the $100,000 level. During his re-election campaign this year, Trump pitched himself to US voters as the candidate who would bring the crypto industry out of its “dark period” – defined for many as the absence of clear digital assets regulation – and add legitimacy to the young growing crypto industry. Another Trump term may serve as a macro catalyst implying larger budget deficits, potentially more inflation, a possible strategic reserve, and changes to the role of the dollar internationally — items that speculators see as a positive impact on the price of bitcoin. Last, options on bitcoin ETFs options are set to list soon, which would usher in a new way to trade and speculate on various cryptocurrencies.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of November 30, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures or visit our website at perigonwealth.com.”