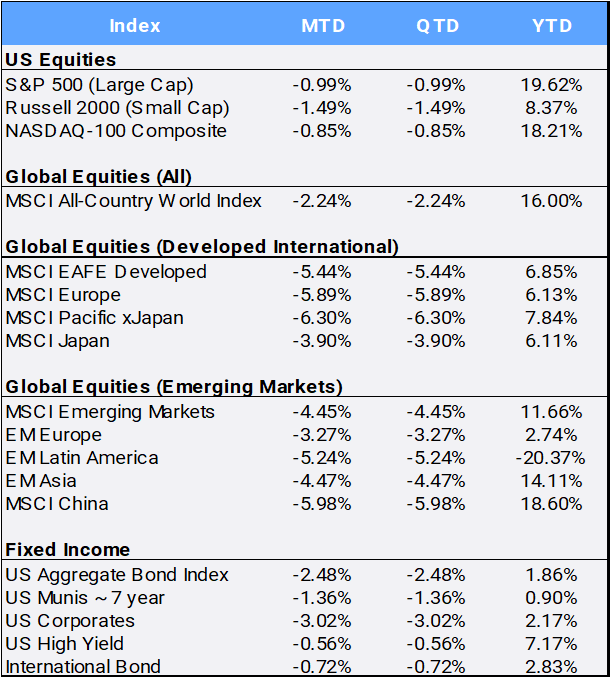

Global equities made two new all-time highs in October, yet the MSCI All Country World Index’s (ACWI) finished down 2.24% on the month, bringing the global benchmark for stocks to up 16.00% on the year. As of month’s end, we’re days away from a historic US election, and investors are hedging their positions ahead of possible macroeconomic implications, as the CBOE S&P Volatility Index (VIX) closed October at 23.16, up 38.43% from last month. The index often referred to as “the fear index”, is up 86.02% from where it started the year – at a complacent 12.45. Recall, the greater the market perceives risk, the greater it will pay for insurance in the price of options to insure their portfolios. It is designed to reflect investors’ view of future US stock market volatility — in other words, how much investors think the S&P 500 Index will fluctuate in the next 30 days.

Click the image to view the chart larger.

Source: Bloomberg Pricing Data, as of October 31, 2024

In “scary” Halloween trading the US S&P 500 index tumbled 1.86% on October 31st, to bring the US bellwether large cap index down 0.99% on the month. The index hadn’t lost all its gains for the month of October on the last trading day since 2009. Investors have set a high bar for Big Tech earnings, and some couldn’t meet their great expectations. Both Microsoft and Meta reported at the end of the month, and saw their shares sell off despite good earnings. Microsoft’s revenue guidance disappointed investors and overshadowed a quarterly earnings beat. Meta Platforms dropped after the Facebook parent missed expectations for user growth and warned that capital expenditures will rise significantly in 2025. Also, Super Micro Computer was added to the S&P 500 earlier in the month and had been an “artificial intelligence” darling, yet plunged over 30% in October after its auditor, Ernst & Young, quit in dramatic fashion saying it would not stand by the financial statements of the company.

Seven of the 11 S&P 500 sectors lost ground this month, with Health Care and Consumer Staples being the worst performers, down 4.62% and 3.49% respectively in October. Only Financials, Communications, and Energy were able to post gains, climbing 2.69%, 1.85%, and 0.92%, respectively.

In addition to the US election, the first week of November will also have the next meeting of the US Federal Reserve. The central bank is expected to lower rates by 25 basis points next Thursday, as most of the recent data has shown an economy that is holding up but slowing gradually. The first estimate of US Q3 GDP gained 2.8%, missing its 3.1% estimate due to higher imports and a drop in housing investment. Also, the personal consumption expenditures (PCE) price index, the Fed’s preferred inflation gauge, latest reading showed inflation rose at a rate of 2.1%, nearing the Fed’s 2% target inflation rate. Depending on the timeliness of Tuesday’s election results, the Fed may have more to say about its future policy path. Until then, however, policymakers are currently in a so-called “blackout period” ahead of the Nov. 6-7 meeting, which means they will not be delivering commentary on any data releases until then, or about their general policy and economic expectations.

US Treasury yields rose across the curve with big swings in the US 2- and 10-year rates that closed October at 4.17% and 4.28% – up 14.53% and 13.32%, respectively, from September. As yields and prices have an inverted relationship, the US Aggregate Bond Index dove 2.48% to bring YTD returns to 1.86%. Overseas, international bonds fell 0.72% on the month but are still up 2.83% YTD.

In international equity markets, both developed and emerging markets slumped in October, falling 5.44% and 4.45% respectively. The International Monetary Fund issued a generally optimistic global economic outlook, foreseeing faster growth from the US while warning of deteriorating productivity from other developed countries, mainly in Europe. Meanwhile in Emerging Markets, the BRICS Summit of emerging economies (as represented by Brazil, Russia, India, China, and South Africa) closed last week’s meeting in Russia with much chatter but little details about how it might create new payment and trade structures to compete with the West and the long-standing US dollar as the hub currency for international trade.

Crude oil prices initially plunged after Israel’s limited retaliation against Iran but recovered to end October with a 1.60% gain. YTD, oil is off 3.34%. Comparatively, the diversified Bloomberg Commodity Index slipped 1.85% MTD to bring YTD returns to up 3.89%. Gold traded at a record high of $2,790.15 as safe-haven demand ahead of the US presidential election helped the precious metal log its fourth straight monthly gain. It appreciated 4.15% in October to bring its YTD gain to 33.01%.

There have been major developments in cryptocurrency markets this year, including the approval of Bitcoin exchange-traded funds (ETFs) in January, the latest Bitcoin halving, and the launch of Ethereum ETFs in July. Spot Bitcoin prices spiked in October and traded within just $200 off its March high. Bitcoin, the asset known as “digital gold” climbed 9.65% in October to bring 2024 gains to 66.77% YTD.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Data Source: Bloomberg Pricing Data, as of October 31, 2024.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures or visit our website at perigonwealth.com.”