Understand what direct indexing is, what the advantages (and disadvantages) are, and when it’s most appropriate.

Recently, there seems to be a lot of buzz around a tool called “direct indexing”. More and more Perigon clients are using it in their portfolios, and I’ve even seen it in consumer-facing marketing from financial companies.

But it is not a simple concept, so it seemed like a good time to explain why we use direct indexing, what its advantages (and disadvantages) are, and when it’s most appropriate.

First, some backstory: Over time, investment options have changed as technology has evolved. Even mutual funds first emerged as a new way to own a broad set of stocks; later on, index funds and ETFs emerged to offer more efficient and inexpensive ways to invest.

More recently, financial analytics technology has offered a newer approach, called “direct indexing.” In some ways, it goes back to the future, putting individual stocks at the center of the portfolio approach – but with some key differences.

What is direct indexing?

At the most basic level, it’s using a basket of individual stocks to replicate the returns of a given stock market index, or benchmark.

That index could be, for instance, the S&P 500 (which represents large-cap U.S. stocks) or the All-Country World Index (global stocks) – or whatever else you and your advisor choose.

With direct indexing, rather than owning a mutual fund or ETF that tracks the index, you own individual holdings in the index. But if you’re tracking the S&P 500, say, you don’t need to own all 500 stocks. More likely, you’ll own a subset – enough to get you close to the index’s overall return.

Is direct indexing the same as stock picking?

One reason direct indexing can be hard to explain is that holding individual stocks can sound like stock picking, or what we often call “active management.”

But in this case, the stocks are selected not for individual performance, but for their relationship to a benchmark index — how they move, for instance, or what sector they’re in. Technology platforms have evolved to make this a scalable way of managing client portfolios, so there’s an advanced algorithm helping us make the selection.

The end goal is to minimize something called “tracking error” – the difference between your portfolio’s performance and that of the underlying index.

Why use direct indexing? Start with tax impact

There are three primary reasons a client might want to use direct indexing, but the first and most powerful is tax advantage. When funding an account with cash, direct indexing can give you the ability to turbocharge “tax-loss harvesting” in that account.

Tax-loss harvesting means selling a stock when it’s down, capturing that tax loss, and then substituting something similar but not identical into the portfolio.

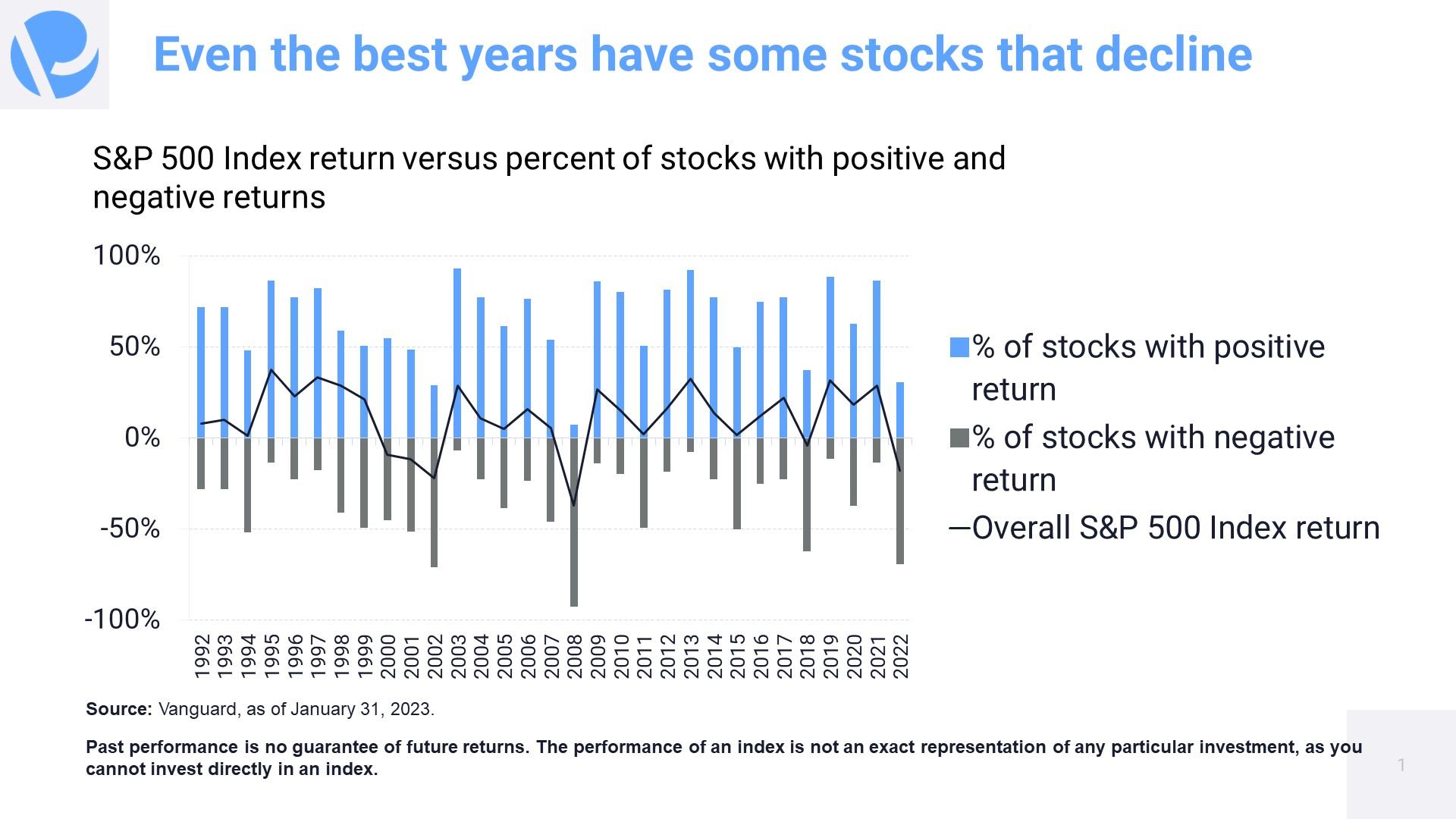

In any given year, even when an index is up overall, some portion of its component stocks will likely be down while others have risen.

Once you invest into a direct indexing portfolio with cash, the investment team will actively monitor the portfolio for opportunities to sell individual stocks that are at a loss, sell when appropriate, and use the algorithm to help select a replacement stock.

Any tax losses get captured and can be used for a variety of purposes: to offset capital gains taken in the portfolio or in another part of your life (a business sale, for instance), to whittle down the tax bill on ordinary earned income (particularly valuable for high earners), or even to be banked against future gains.

Diversifying a concentrated position

Another use for direct indexing: when clients have existing concentrated stock positions with significant embedded gains.

You may not want to just sell all those long-held stocks to diversify, because that would involve a big tax hit. So you’d sell a portion, put both the original stock and the cash proceeds into a direct indexing account, and then manage around the existing positions. Over time, any harvested losses help you diversify further.

Embedding values in a portfolio

A third reason for direct indexing is when you have certain values that you want expressed. A client who wants to avoid guns and munitions, say, can exclude individual companies in a very specific, customized way. Values-based requirements may be broad or narrow, but direct indexing gives clients the ability to prioritize the issues that matter most to them.

When direct indexing doesn’t work

So should everyone use direct indexing for all their accounts? Not quite.

The most obvious reason to skip: If you’re doing something largely for the tax benefit, then don’t bother in a tax-deferred retirement account, or in a tax-free Roth account.

Meanwhile, accounts generally need critical mass to be able to properly mirror the indexes – so a smaller account would probably be better off using an ETF rather than direct indexing.

Direct indexing also works better for high-income clients who are actively saving and investing, rather than for someone who is draining their accounts. The tax advantage is particularly valuable while clients are in higher tax brackets, and cash inflows can help rebalance accounts to the index. Meanwhile, a declining account balance puts clients at risk of falling below that critical mass.

If you think direct indexing is something that might be appropriate for you, please reach out to your advisor to ask about it.

Disclosure Statement

Perigon Wealth Management, LLC (‘Perigon’) is an independent investment adviser registered under the Investment Advisers Act of 1940. More information about the firm can be found in its Form ADV Part 2, which is available upon request by calling 415-430-4140 or by emailing compliance@perigonwealth.com

Performance

Past performance is not an indicator of future results. Additionally, because we do not render legal or tax advice, this report should not be regarded as such. The value of your investments and the income derived from them can go down as well as up. This does not constitute an offer to buy or sell and cannot be relied on as a representation that any transaction necessarily could have been or can be affected at the stated price.

The material contained in this document is for information purposes only. Perigon does not warrant the accuracy of the information provided herein for any particular purpose.

Additional Information regarding our investment strategies, and the underlying calculations of our composites is available upon request.

Annual Form ADV

Every client may request a copy of our most current Form ADV Part II. This document serves as our “brochure” to our clients and contains information and disclosures as required by law.

Perigon Wealth Management, LLC is a registered investment advisor. Information in this message is for the intended recipient[s] only. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable. Please click here for important disclosures.”